Early this year, we put together a 2021 outlook for builders’ risk and construction.

The pandemic sent the world of construction array. The cost of materials skyrocketed while contractors and those in the construction and building industries faced increased costs.

The demand for builders was high due to the pandemic’s stay-at-home order and the essential status most builders received during the lockdown. Almost every business insurance renewal saw increases in insurance costs as well.

Needless to say, it was a busy year. But now, as 2021 comes to a close, it’s important to similarly analyze the upcoming year: 2022. So, here’s what to expect from changing contractor costs according to Brenda Jo Robyn, founder of Competitive Edge Insurance.

What is Happening with Changing Contractor Costs?

Prices are going up everywhere, according to Brenda Jo. “For contractors, it’s been the perfect storm. With COVID, fortunately, [contractors] were able to keep going forward and making things move.”

As a result of the COVID-19 pandemic, a high volume of money was made available to contractors from the government so that these construction projects did not halt to a standstill. At the same time, interest rates plummeted.

This, in turn, increased homeowners’ desire to renovate their properties. And lastly, as Brenda Jo mentions, we had a massive sell off of homes during this last summer. Now is the time that people want to update.

Potential Contracting Issues

Although the cost of materials is starting to level off quite a bit—down 20 to 25%, according to Brenda Jo—the delays are not lifting. Brenda Jo works with a high number of contractors, and word has it they’re being forced to purchase materials up front to combat delays. The problem with this, however, is that some contractors aren’t getting paid back from developers or homeowners.

“Because stuff is so delayed, a lot of [vendors] are requiring payment upfront before they even order it out,” says Brenda Jo. Another thing that is starting to really impact costs is the shortage of employees.

The solution? “There has to be some strategic planning by a contractor in moving forward with contracts,” says Brenda Jo.

How Are We Seeing Contractors React?

“More strategic contractors are putting these material increases into their contracts. There is an agreement between the owner, developer, and contractor that if there are increases… it’s signed off on before they go ahead and outlay.”

How Can Contractors Mitigate Risk?

Written contracts are especially golden right now.

Be sure to include caveats on:

- Shortages in materials

- Delay in materials

- Increased cost of materials

- Shortages in labor

These elements should all be addressed in your contract.

It’s equally important to document everything. As Brenda Jo likes to say, “Document, document document.” This doesn’t mean solely the written contract mentioned above, but documentation of:

- Progress payment requests

- Material purchase invoices coupled with the photos of how the project was when you started

- When you got to the next phase with the invoice that you’re sending…

Continue on like that, so that you are a hundred percent prepared, should you need to file a lawsuit due to breach of contract from non-payment from your developer or homeowner,” recommends Brenda Jo.

Lastly, according to Brenda Jo, the most powerful tool to get payments is with the mechanic’s lien. “Get a pre-lien, send out the notices, and if you’re not paid, go ahead and enforce the mechanic’s lien on the property.”

What Do Homeowners Need to Know?

If you delay, you may find that costs go down in the materials. You also, however, may find that you don’t have any contractors left that are able to actually work for you.

Brenda Jo recommends you do your due diligence on the homeowner’s side and work with your banks. She also doesn’t feel that costs will decrease anytime soon. “You’re [either] going to have a lengthier build or you’re going to have more costs,” says Brenda Jo. “And if you wait too long, you’re going to have both.”

Look to the Experts

As you look at your coverage, think of the potential for shock losses, evaluate your tolerance for risk, review your industry’s compliance guidelines, and take the time to look at your policies in detail. As experts, we at Competitive Edge can tell you where you are vulnerable and what the risk might cost you. From there, it is your decision to accept the risk or mitigate it with coverage. Contact Competitive Edge today for tricky insurance needs and guidance.

For the 2021 builders’ risk and construction outlook, read on below:

2021 Builders’ Risk and Construction Outlook

The cost of materials is skyrocketing while contractors and those in the construction and building industries face increased costs. Demand is high for builders thanks to the pandemic’s stay-at-home order and the essential status most builders received during the lockdown. With a busy year ahead, it can be easy to take your eye off the potential for increased risk with heightened business and scope of work.

Insurance rates spiked during the pandemic. The elevation in loss claims from the many businesses that were negatively impacted by caused insurance rates that have been flat or close to flat for close to a decade to increase rapidly. Almost every business insurance renewal is seeing increases in insurance costs.

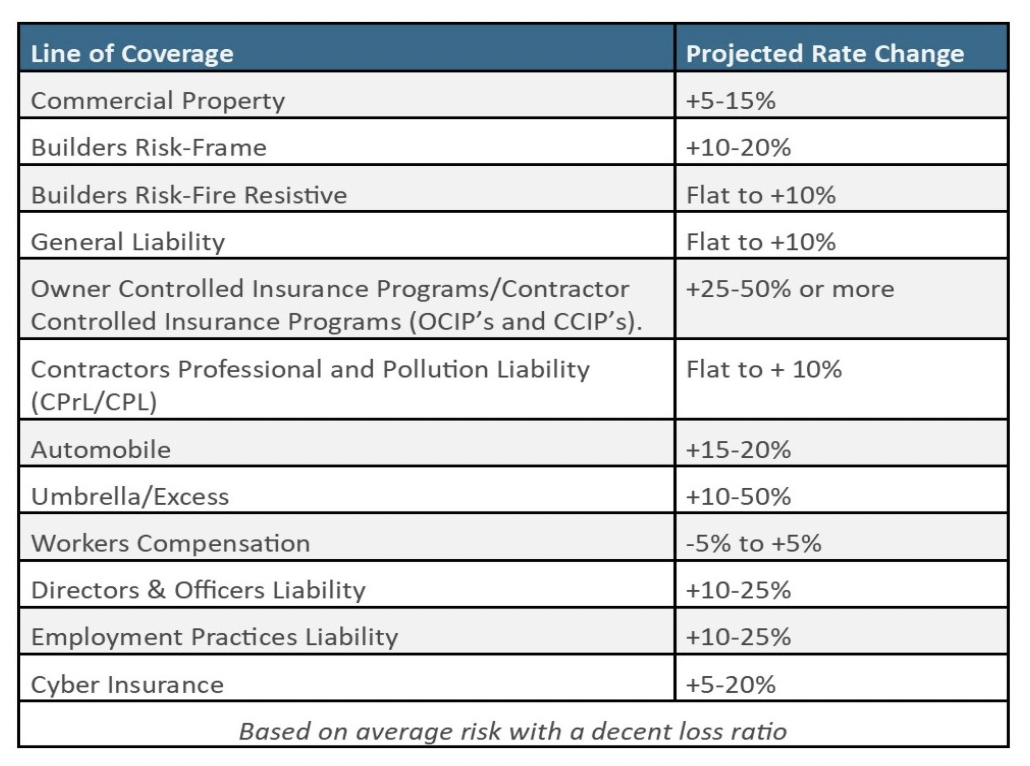

This chart from Construction Executive shows projections of increases by lines of coverage and is meant as a reference since each insured party will have its own risk and coverage limitations.

Skilled Labor Shortages

Shortages persist throughout the construction and building industries. When coupled with the increase in material costs and the need to pay more for labor in order to get any labor at all, contractors may feel some pressure. The balance sheets of contractors who received PPP funds have yet to find resolution on forgiveness of those debts can drive up their risk profiles causing carriers to increase rates or even deny renewals.

Some Insurance Markets Remain Steady

Worker’s Compensation is holding steady with estimates of -5% – +5%. The possible increase, however, will happen when employers see their rates go up to offset COVID-related layoffs and furloughs as yet unaccounted for in the above numbers. California is especially affected in this regard and in terms of employment practices liability coverage.

Cyber Liability Coverage

No longer the purview of only tech companies, every business will need cyber liability coverage. Online billing, work orders, web-based CRMs, and other data collection methods are the way of the future (and the present). Construction companies that do not invest in cyber coverage leave themselves open to ransomware and the potential of having to shell out large sums of money to retrieve their data from hackers. It is estimated that cybercrime is committed every 11 seconds.

For the first time in decades, the commercial insurance industry is in a hard market cycle. With increasing rates and more stringent criteria for everything from umbrella policies to surety bonds, the time to price-shop coverage is long since passed.