EIDLs and Hazard Insurance: Your Full Guide

When running a business, there are so many things to keep track of—especially considering the COVID-19 hullabaloo we’ve experienced over the past nearly two years. Various types of insurance, Small Business Administration (SBA) loan requirements… the list goes on.

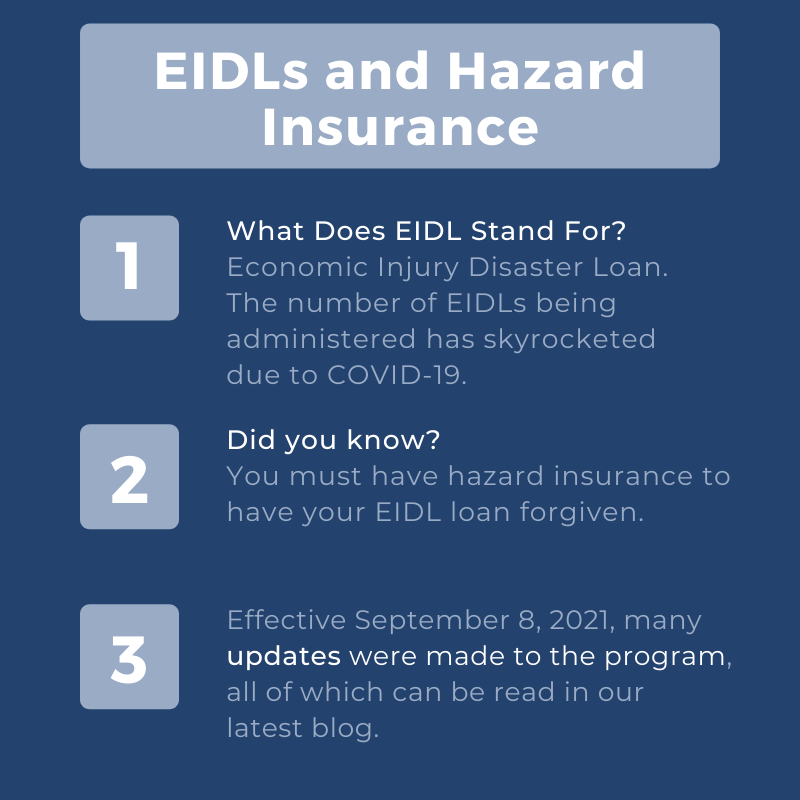

An important topic that continues to change, however, is Economic Injury Disaster Loans (EIDL) and the subsequent need for hazard insurance if it is collateralized. This brings up many questions, like

- How much does it cost?

- Why do I need it?

- How can I obtain coverage?

Each of these questions and more is answered in this article: Economic Injury Disaster Loans (EIDL) Hazard Insurance: Your Full Guide.

Let’s dive in.

What are Economic Injury Disaster Loans (EIDLs)?

EIDLs are “the primary form of Federal assistance for the repair and rebuilding of non-farm, private sector disaster losses” administered by the SBA. “The disaster loan program is the only form of SBA assistance not limited to small businesses.”

An Update on EIDL

Over the summer, many small business owners received an alarming email from the EIDL program through the SBA.

As part of the EIDL requirements, you must have hazard insurance in order to apply for the EIDL loan. In the email from the SBA sent earlier this year, individuals were informed that those who had received the EIDL loan, must present proof of insurance in order to have their loans forgiven.

Here’s a look at what the email said.

The Email Stated:

“The SBA is launching a new round of EIDL Advances – called Targeted EIDL Advance – which provides eligible businesses with $10,000 in total grant assistance. If you received the EIDL Advance last year in an amount less than $10,000, you may be eligible to receive the difference up to the full $10,000. The combined amount of the Targeted EIDL Advance and any previously received Advance will not exceed $10,000.”

Along with Information Claiming That:

“Businesses eligible for the Targeted EIDL Advance must meet ALL the following eligibility criteria:

- Located in a low-income community, as defined in section 45D(e) of the Internal Revenue Code. The SBA will map your business address to determine if you are in a low-income community when you submit your Targeted EIDL Advance application.

- Suffered economic loss greater than 30 percent, as demonstrated by an 8-week period beginning on March 2, 2020, or later, compared to the previous year. You will be required to provide the total amount of monthly gross receipts from January 2019 to the current month-to-date.

- Must have 300 or fewer employees. Business entities normally eligible for the EIDL program are eligible, including sole proprietors, independent contractors, and private, nonprofit organizations. However, agricultural enterprises, such as farmers and ranchers, are not eligible to receive the Targeted EIDL Advance.”

The SBA said loans won’t be forgiven unless you have proof of insurance coverage. If you’re looking to check which COVID-19 loans are forgivable, visit this list.

But Why Do You Need Hazard Insurance to Qualify?

“The Small Business Administration is a lender. Just like any other lender, the SBA is trying to protect their loan’s collateral from unforeseen circumstances,” says Naomi Bishop on hazard insurance. Therefore, all borrowers must obtain hazard insurance within 12 months of loan approval. Additionally, coverage must be maintained throughout the life of the loan.

Additionally, when applying for a loan, you guarantee a loan by offering assets as collateral. For example, financial (i.e. cash and cash equivalents), physical (real estate), vehicles, and so on.

If you then default on an SBA loan, the lender has the right to seize and sell assets as repayment. Even others’ collateral may be at risk if they signed a guarantee on the loan. For this reason, insurance is crucial to keeping your business and others safe.

More on Hazard Insurance

Under the requirements for the EIDL, the SBA requires that your business has hazard insurance to cover 80% of the loan amount. Hazard insurance is a term for coverage that may be included within several different types of property coverage.

If you have any kind of business property insurance, you are likely covered. In fact, commercial property insurance is considered hazard insurance. This coverage protects your company’s physical assets, like buildings, furniture and equipment, supplies, computers, inventory, customer’s goods, signs, fencing, and even lost income from damage or loss.

The SBA does not allow personal hazard insurance to be considered for loans. Business auto insurance is also not allowable coverage for this requirement.

What is Happening Now?

Effective September 8, 2021, many updates were made to the COVID EIDL program. All of which can be read in full here on the SBA website.

The impact of the primary policy changes include:

- Higher loan amounts are available

- Increase[d] use of funds flexibility

- SBA automatically defers for 24 months from loan origination

- Simplifies affiliation rules for all industries…

- Created additional way[s] to meet program size standards… to include industries uniquely impacted by COVID-19 [that] continue to experience significant economic hardship

- Introduces maximum cap on corporate groups

Do You Have the Right Coverage and Correct Amounts to Satisfy Your SBA Loan?

As previously mentioned, the SBA requires that at least 80% of your loan amount is covered with hazard insurance. It may be beneficial to have 100% of your business property value covered with hazard insurance. If you received EIDL funds without coverage, you should contact your insurance agent as soon as possible.

There are a few other rules related to the insurance coverage that the SBA has stated:

- The insurance must be in the name of the business and must show proof of business property.

- If someone is a sole proprietor, and they have a DBA (Doing Business As), the DBA must be on the policy.

How Much Does Hazard Insurance Cost?

The premiums that one pays for hazard insurance is dependant on several factors, including:

- Selected limits and deductibles

- Type of coverage

- Where you live (some states are more prone to natural disasters than others)

Although this is not an end-all-be-all formula, for homeowners, the annual cost of hazard insurance typically costs between 0.25% to 0.33% multiplied by the purchase price of your home.

Hazard insurance doesn’t have to cost an arm and a leg. By comparing rates with the help of Competitive Edge Insurance, you’re sure to get the best deal for your business while making sure you stay compliant with the SBA’s requirements.

Curious about the difference between hazard insurance and high-risk insurance? Competitive Edge specializes in high-risk insurance— learn “What Classifies High Risk.”