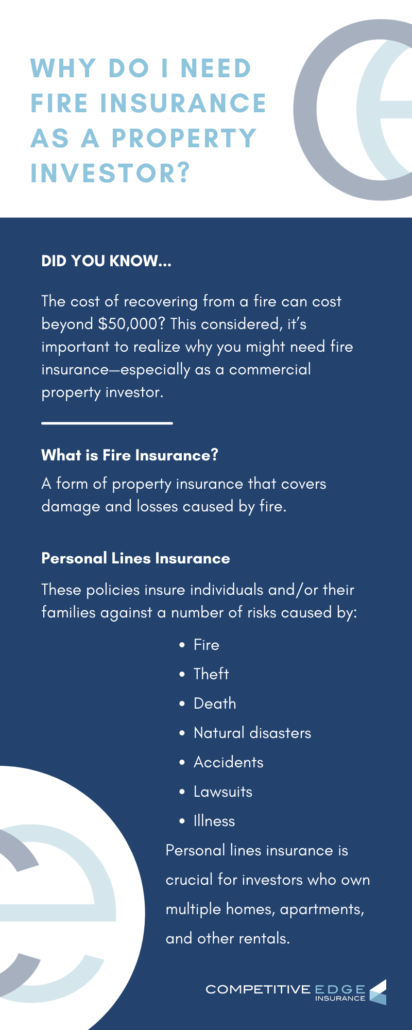

Why Do I Need Fire Insurance as a Property Investor?

According to The National Fire Protection Association (NFPA), U.S. fire departments responded to about 353,100 house fires from 2014 to 2018. Moreover, the cost of recovering from a fire can range anywhere from $3,000 for a small fire and beyond $50,000 for larger fires.

This considered, it’s important to consider why you might need fire insurance—especially as a commercial property investor. Let’s discuss.

What is Fire Insurance?

Fire insurance is defined as “a form of property insurance that covers damage and losses caused by fire.” Although most homeowners’ policies come with some form of fire protection, additional coverage is often considered in the case that property is lost or damaged due to fire.

The topic of fire insurance is especially important for those who own investment properties. How many investment properties you own, could determine whether or not you’re able to use personal lines of insurance to cover fire-related issues.

Personal Lines Insurance

What is personal lines insurance? Personal lines insurance refers to any insurance that covers against “loss that results from death, injury, or loss of property.” These policies insure individuals and/or their families against a number of personal (and therefore, financial) risks caused by:

- Fire

- Theft

- Death

- Natural disasters

- Accidents

- Lawsuits

- Illness

Personal lines insurance is especially crucial for investors that may own multiple homes, apartments, and other rentals. Whether it be a wildfire or house fire, consider how much a property investor has to lose when it comes to this type of natural disaster.

As an investor, you need to be sure that your interests are fully insured. We can help you achieve this at Competitive Edge Insurance.

Insuring Your Personal Property

Today, the costs for insurance—fire insurance included—are increasing significantly. Regardless, insuring your property is extremely important. As we’ve mentioned, this is especially true for individuals who own investment properties; both commercial and residential.

There are many insurance options out there. Personal lines include:

- Single-family homes

- Individual condominium units

- Temporary rental properties

- Multi-family properties from one to four units.

Investment property insurance varies on a property-by-property basis and can be written on either a personal or a commercial policy. If you own fewer than 4 properties, you can use personal insurance policies—even though it’s your business.

Whether you’re an investor yourself, or an attorney or financial planner working with clients who invest in property, you must be sure these investments are fully insured without umbrellas so that the total limits of liability exceeds your property assets.

Remember: All costs are going up, so property owners must plan accordingly.

This is an especially difficult pill for property owners and landlords to swallow. Although insurance is going up, you can’t increase rent by more than five to seven percent to bridge this gap.

For more information on how to insure your property, contact our team of experts at Competitive Edge Insurance. Until then, read up to find out what your homeowners insurance covers.