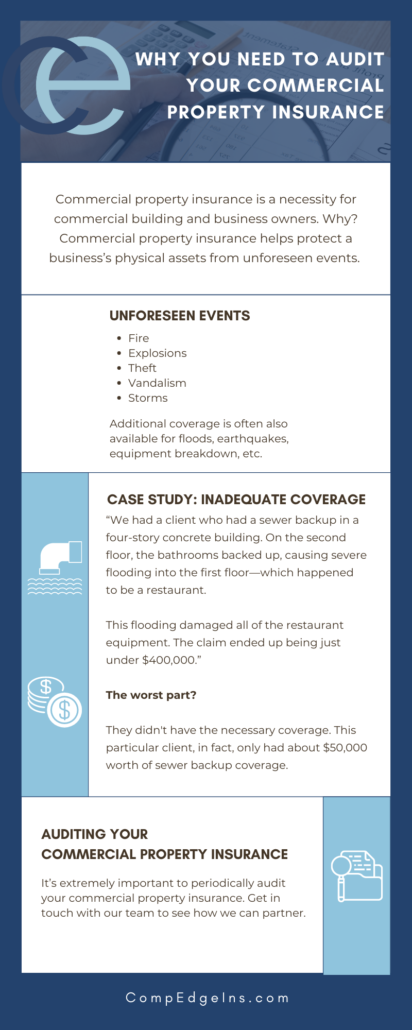

Why You Need to Audit Your Commercial Property Insurance

Commercial property insurance is a necessity for commercial buildings and business owners. Why? Commercial property insurance helps protect a business’s physical assets from unforeseen events. Some examples of these events include:

- Fire

- Explosions

- Theft

- Vandalism

- Storms

According to Nationwide, additional coverage is often also available for floods, earthquakes, equipment breakdown, and other causes of loss to your business.

Here, we have Brenda Jo Robyn, founder of Competitive Edge Insurance, sharing a story of a client who did not have the proper commercial property insurance, and why you need to audit your commercial property insurance to avoid a similar experience.

What Can Happen if I Don’t Have Adequate Commercial Property Insurance?

“We had a client who had a sewer backup in a four-story concrete building. On the second floor, the bathrooms backed up, causing severe flooding into the first floor—which happened to be a restaurant.

This flooding damaged all of the restaurant equipment. The claim ended up being just under $400,000.”

The worst part?

They didn’t have the necessary coverage. This particular client, in fact, only had about $50,000 worth of sewer backup coverage.

Auditing Your Commercial Property Insurance

This example considered, it’s extremely important to periodically audit your commercial property insurance.

This particular example actually encouraged our team to take a look at additional insurance areas that might be lacking. It became an opportunity.

For example, this same client had executive suites full of costly desks and computers—but no business personal property.

Hypothetically, if the sewer backup had flooded onto that executive suite floor, what would have happened? Remember, insurance audits are all about thinking ahead and considering the ‘what ifs?’

“So, our team at Competitive Edge went around and took a look at everything. We looked at the HVAC system; the client didn’t have enough insurance for that system to be replaced if something happened. Moreover, this client provided computer services to its clients and had server rooms next to the elevators. These rooms also weren’t covered.

During our insurance audit, we went in and did a full assessment of both:

- The structure of the building

- What was inside the building and what the client was responsible for

Interested in learning more about commercial property insurance? Read on in our article “Property Owners: What Commercial Insurance Do You Need?” for five types to consider.