How to COPE in an Inflationary Environment

Recently, Hartford did a study that showed that 75% of all commercial buildings were underinsured. And of those that were underinsured, they’re at 40% underinsured. That means that if you have a property that’s worth a million dollars, you’re only having it insured for 600,000.

If you have a catastrophe, you’re only going to get paid the 600,000 for the rebuild costs now, and not the million dollars that it’s going to cost to make you whole again. What’s really important for commercial building owners is to understand how the insurance carriers rate your properties and it’s called COPE, C-O-P-E: construction, occupancy, protection, and exposure.

In this blog, we’ll discuss COPE and learn more about it directly from the founder of Competitive Edge Insurance, Brenda Jo Robyn.

What is COPE?

As a commercial building owner, it’s important to understand how your property is being rated for insurance purposes. The four main factors that go into this rating are construction, occupancy, protection, and exposure (COPE).

Construction is how your building is built. Things like the roof, walls, windows, and doors all factor into how well your building can withstand a disaster.

- What is the building made of?

- What is the age of the building?

All commercial buildings are going to be rated on a scale of 1 to 10, with 1 being the best. So if you have a fire resistant building, that would be a 1. If you had a wood frame building, that would be a 10.

Occupancy is what your building is used for. If you have a lot of people coming in and out of your building, or if you have hazardous materials inside, that will affect your rates.

- Who’s in it?

- Is it manufacturing? Is it retail?

So if you have a retail store, that would be a low hazard. If you had a chemical plant, that would be a high hazard.

Protection is what you do to protect your building. Things like security systems, sprinklers, and alarm systems can help lower your rates.

- What are the protections you have there?

- How far away is the fire department?

- Do you have a fire hydrant on your block?

So if you have automatic sprinklers, that’s going to give you a better fire rating.

Exposure is how likely your building is to be damaged in a disaster. If you’re in a high-risk area for hurricanes or tornadoes, your rates will be higher than if you’re in a low-risk area.

- What is around your building? Fire brush, lakes, potentials for flood?

- What is the neighborhood like? Is it in a crime area?

If you’re on a busy street, that’s going to be a high exposure. If you’re in the middle of a field, that’s going to be a low exposure.

All these factors are what carriers take a look at. Understanding COPE can help you make sure you’re getting the best possible rate on your commercial property insurance.

Instability Caused By Inflation

Currently, insurance rates have been increasing and they have also been very unstable for the last year. The instability is being caused by inflation.

Supply Chain Issues

The raw material costs are all over the place. They don’t know how much they’re gonna cost when they get ordered by the contractor. Some can order it a week out and some are being told, “Hey, here’s your bill now, but when it comes in, we’re gonna give you what the real cost is.” Obviously, the sluggish supply chain issues haven’t gone away.

Demand for Skilled Labor

There’s a high demand for skilled labor. Not only are we having people retire, but we don’t have enough people being apprentices and it’s not being able to translate to more people being able to do a job.

Lingering COVID Effect

And lastly, the lingering COVID effect. Unfortunately, during COVID, people were placing insurance on buildings that were only looked at over the internet on your desktop. And what they come to find out later is that the building has not been maintained, that there’s storage of plastics in there and there’s no sprinkler system. So this has all led to an increase of rates.

What Can You Do?

And what can you do? In order to be a building owner that’s gonna continue to make money, you have to control your costs. And how do you do that? You have to make a commitment to do so, and you’re gonna do it by controlling your losses.

Steps to control your costs:

- Maintain your buildings

- Update the electrical wire, heating, plumbing, roofing

- Have good housekeeping

- Perform regular safety checks

What is it that’s been able to be implemented in the last three years so that it protects your office building better now than it was three years ago? All these things will go ahead and poise you into a place where the carrier will look at you favorably and give you more credits.

When you are able to show the insurance company that you are in a mode of safety, maintenance, and security, carriers will give you rates that you can live with and you won’t have to pass on to your customers. It’s a win-win for everybody.

A Final Word

All of these things go into how the insurance carrier rates your property and what they’re going to charge you for premiums. As a commercial building owner, it’s important for you to understand how your property is being rated so that you can make sure you’re properly insured. If you have any questions about your commercial property insurance coverage, reach out to us today!

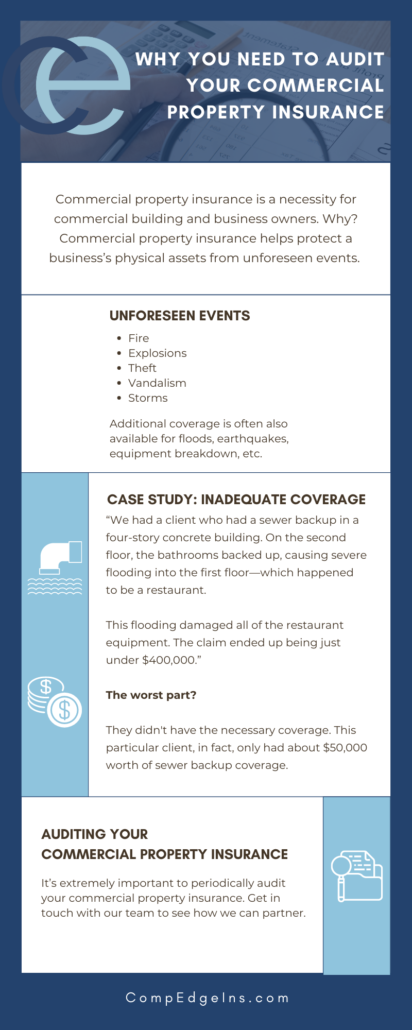

Or if you’re interested in learning more from Brenda Jo, you can check out her other videos including, Why You Need to Audit Your Commercial Property Insurance.