How Does a Building Owner Know if They Are Underinsured?

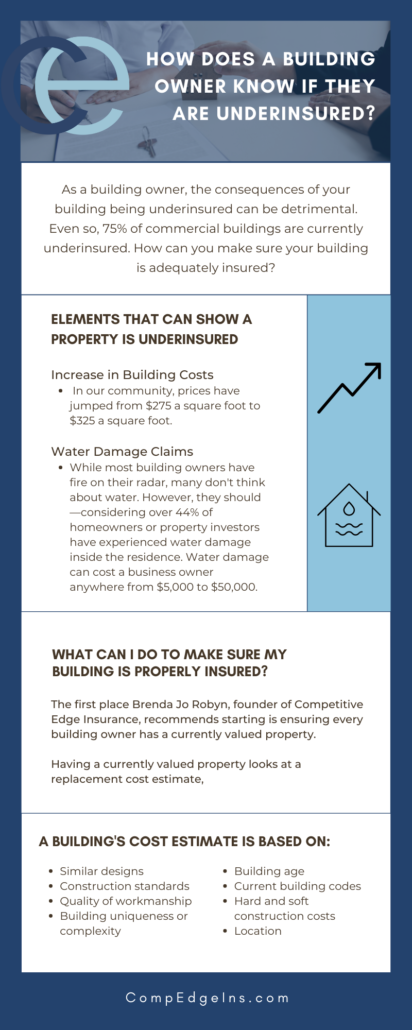

As a building owner, the consequences of your building being underinsured can be detrimental. Even so, 75% of commercial buildings are currently underinsured. As a building owner or property investor, how can you make sure your building is adequately insured?

Today, we have Brenda Jo Robyn, founder of Competitive Edge Insurance, on camera to answer this question. What elements can you look at to identify if you’re underinsured? What steps can you take to stay adequately insured?

Let’s see what she has to say.

Elements That Can Show a Property is Underinsured

Picture this: You have a building, but don’t know the last time it was evaluated in terms of a replacement cost. The building has most likely had some renovations in the last five to 10 years.

This considered, what elements do you need to look at to see if your building is underinsured?

Increase in Building Costs

As many have well noticed, the average cost of buildings has gone up. In our community, where the Competitive Edge office is housed, prices have jumped from $275 a square foot to $325 a square foot.

When you’re insuring your building, it’s really important to take this shift into consideration. Moreover, consider appraising the building for the replacement to rebuild from the ground up (but more on this later).

Water Damage Claims

Secondly, most building owners have little or no protection for water damage claims. Hold on… Don’t roll your eyes yet!

While most building owners have fire on their radar, many don’t think about water. However, they should—considering over 44% of homeowners or property investors have experienced water damage inside the residence.

Water damage can cost a business owner anywhere from $5,000 to $50,000. Today, we’re seeing more $50,000 to $75,000 claims being paid. And why is that?

There are many ways this can happen. Imagine this scenario: A building owner goes away for the weekend, and there’s been a leak he or she doesn’t know about. Or, maybe it’s in a commercial building and a toilet is leaking into the floor below. Again, the owner is three to four days out, and all of a sudden now there’s mold. It may be in the walls and have to be remediated. It can be quite costly to repair that.

Regardless, many people have a mere $5,000 worth of water damage on their policy. It’s not enough.

What Can I Do to Make Sure My Building Is Properly Insured?

There’s one primary thing a building owner can and should do to ensure that their building is adequately insured.

Property Valuations

The first place Brenda Jo recommends starting is ensuring every building owner has a currently valued property.

Having a currently valued property looks at a replacement cost estimate, which no, it’s not intended to replace the original asset (unless it’s a reproduction), but the valuation is intended that the new building would be able to serve in the same purpose that the old building existed for.

Every building is unique. So, how do you calculate this cost estimate?

A building’s cost estimate is based on:

- Similar designs

- Construction standards

- Quality of workmanship

- Uniqueness or complexity (i.e. standard building vs. a super custom building)

- Building age

- Common elements

- Current building codes

- Hard construction costs (i.e. materials)

- Soft construction costs (i.e. design plans, demolition costs)

- Location (Is the building in the city or rural?)

Conducting an annual insurance review is also key, and takes little to no time.

It can be difficult to arrive at this figure yourself, which is why our team at Competitive Edge Insurance is here to help.

Now, we’ve talked about water… Let’s chat about protecting your building from fire. Read on to find out why you need fire insurance as a property investor.