The Coverage Pitfalls of Insurtech

With the rise of technology comes the rise of a new sector disrupting the insurance industry: Enter insurtech.

But what is insurtech, and what are its coverage pitfalls? Here, we have Brenda Jo Robyn, founder of Competitive Edge Insurance, on video to discuss the coverage pitfalls of insurtech.

What is Insurtech?

First, what is insurtech? Insurtech is a combination of the words “insurance” and “technology,” and refers to “technological innovations that are created and implemented to improve the efficiency of the insurance industry,” according to TIBCO.

Research shows that the insurtech industry is expected to reach a market size of $114 billion by 2030. This doesn’t come as a surprise considering that this tech helps large insurance companies explore new insurance options without the need for human efforts. Using information gathered from observed behavior, TIBCO says this could include:

- “Dynamically-priced insurance policies

- Small business insurance, and

- Social insurance options

Insurtech also provides insurance companies access to data streams from IoT devices.”

An internet of things (IoT) device is a physical object “with sensors, processing ability, software, and other technologies that connect and exchange data with other devices and systems over the Internet or other communications networks.”

Read on for more information on IoT devices.

The Pitfalls of Insurtech

Insurtech’s technological innovations can scour the internet, pulling information from a host of websites to make an informed insurance assessment.

While technology can sometimes work smarter than traditional insurance methods of insuring a business, insurtech also has its pitfalls.

Insurtech and Underinsurance

When it comes to evaluating and preparing property insurance, insurtech might be able to provide you with information including:

- When the building was constructed

- Permitting information

- When there were last upgrades or renovations completed

Insurtech, however, cannot give you the details of what is inside a specific building. It will not be able to tell you information regarding:

- The tenancy inside a building

- Rooms of high value inside of a building that might require additional coverage (i.e. computer rooms)

So, because of this lack of information, you have a lot of very underinsured individuals when it comes to using insurtech.

Insurtech and Human Touch

As it’s been made clear, you do not receive the same human touch when you opt for insurtech.

At Competitive Edge Insurance, we believe it is helpful to have a professional as your advocate to take a look and give you options—not a technological innovation!

The most important thing that you receive with that human connection, according to Brenda Jo, is that this professional can share that an individual has options.

They can:

- Cover their property at certain limitations, or

- Decide to self-insure

A traditional insurance professional can help determine what self-insurance might look like. For example, what will they be insuring? Is the self-insuring simply increasing the deductible or not having that type of coverage altogether?

Our team at Competitive Edge can help take a look at your unique circumstances to help determine your areas of risk, where you’re covered, where you’re underinsured, and how to amend these pitfalls.

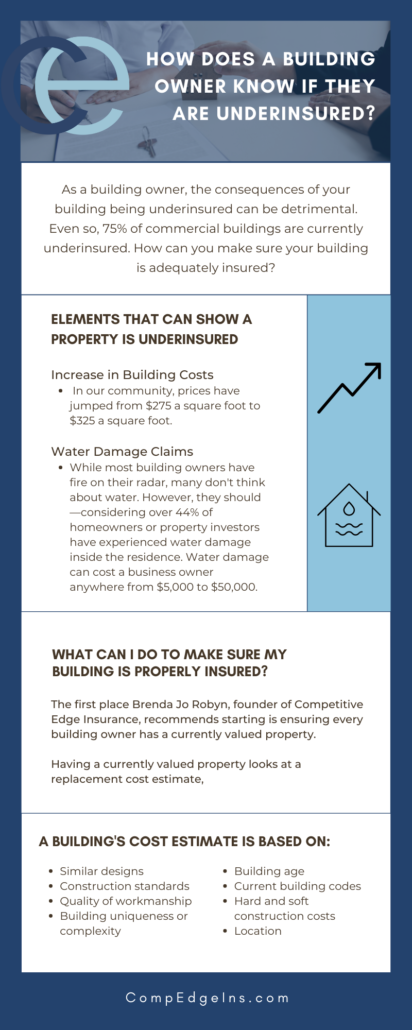

Interested in learning more? Read on in our article “How Does a Building Owner Know if They Are Underinsured?”