Workers’ Compensation Rates are Rising: What Can You Do?

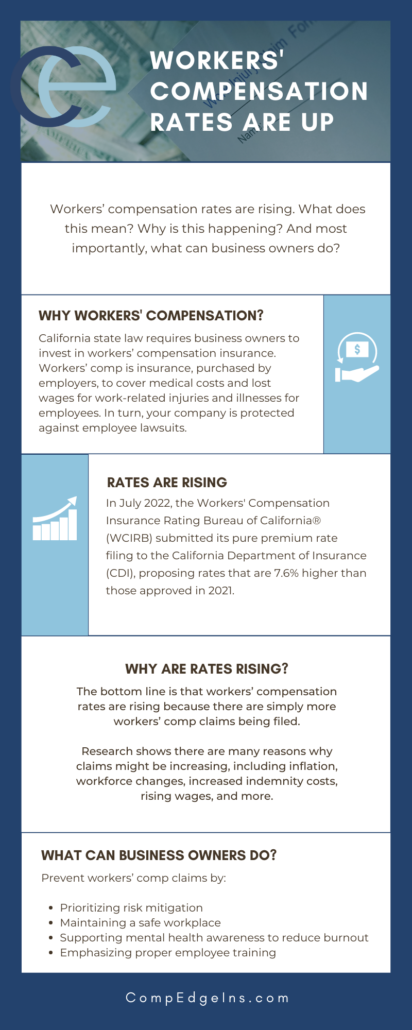

As many business owners may have noticed, workers’ compensation rates are rising. What does this mean? Why is this happening? And most importantly, what can you do as a business owner in response?

Read on to find out.

Why Workers’ Compensation?

If you’re a business owner or an individual who is planning on employing workers when starting a new business, California state law requires you to invest in workers’ compensation insurance.

Why? Employers purchase workers’ compensation insurance to cover the medical costs and lost wages for work-related injuries and illnesses of employees. In turn, workers’ compensation protects your company against employee lawsuits.

Worker’s compensation coverage can help pay for:

- Immediate medical costs (i.e. emergency room expenses)

- Ongoing medical costs (i.e. physical therapy)

- Partial lost wages while the employee is unable to work

Lack of proper coverage can result in fines and even criminal exposure.

Workers’ Compensation Rates Are Rising

Over the past couple of years, workers’ compensation rates have been steadily increasing across the board. They’ve been rising by 7% on average; however, this figure depends on each industry.

Moreover, in July 2022, the Workers’ Compensation Insurance Rating Bureau of California® (WCIRB) submitted its September 1, 2022, pure premium rate filing to the California Department of Insurance (CDI).

The CDI regulates California workers’ compensation rates with the help of the WCIRB, who makes recommendations based on the state’s loss ratio.

In this July 2022 filing, the WCIRB proposed a set of increased premium rates. On average, these rates are 7.6% higher than those approved the year prior on September 1, 2021.

According to the WCIRB, the average of the proposed September 1, 2022, advisory pure premium rates is $1.56 per $100 of payroll.

Read on for the WCIRB filing.

Why Are Workers’ Compensation Rates Rising?

So, why have these premiums been increasing in the first place?

The bottom line is that workers’ compensation rates are rising because there are simply more workers’ comp claims being filed.

Research shows there are many reasons why claims might be increasing, including:

- Medical inflation

- Workforce changes

- The increasing average age of the workforce

- Increased indemnity costs, and

- Rising wages

Moreover, as individuals have begun to return to work in person, the number of claims regarding health and safety in the workplace has increased as well. These claims typically include:

- Employee concerns about exposure to COVID-19 due to unsafe working conditions, or

- Situations where employees allege they were wrongfully denied a request for workplace accommodation or leave

What Can Business Owners Do?

With this rise in claims, what can you do to protect yourself as a business owner? You can prevent workers’ comp claims by:

- Prioritizing risk mitigation

- Maintaining a safe workplace

- Supporting mental health awareness to reduce burnout

- Emphasizing proper employee training

- Developing and distributing an employee handbook and code of ethics policy

- Implementing a handbook auditing procedure

While this list only showcases a few of many ways to avoid high workers’ compensation premiums, it’s important to remember that it’s up to all employers collectively to keep their employees safe—thus, lowering the number of claims being filed annually.

How Much Risk Does Your Business Hold?

If writing your hefty workers’ compensation check has begun to pain you, at Competitive Edge Insurance, we challenge you to ask yourself a question: “Am I, as a business owner, doing everything in my power to create the safest workplace possible?”

If the answer is no (which it typically is), get in touch with our team today to learn what else you can do.

Learn more about 2022 workers’ compensation changes by reading our article “Insurance Trends in 2022: What to Watch For.”