Understanding Classifications for Workers’ Comp Dual Wage

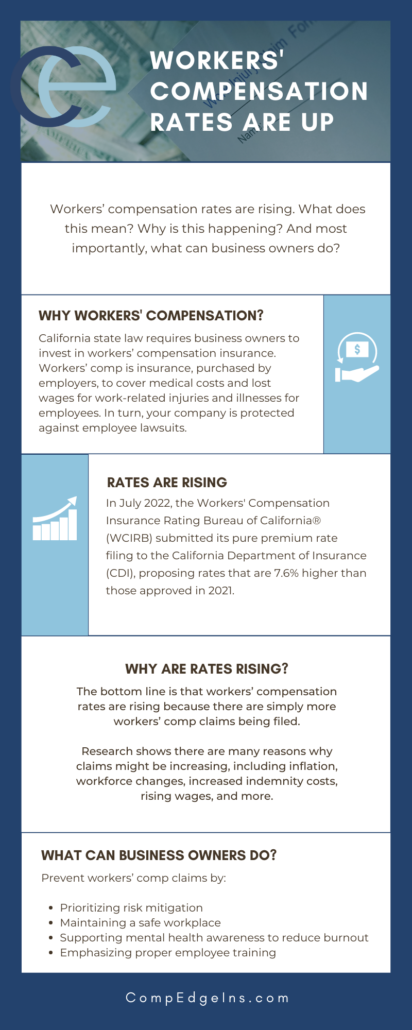

What is happening with workers’ compensation insurance coverage in the construction industry today?

Well, according to Brenda Jo Robyn, founder of Competitive Edge Insurance, workers’ compensation rates are increasing in the construction industry.

Although rates vary by class, dual wage thresholds are going up—and what does this mean for employers? As dual wage thresholds increase, employers will be forced to pay their workers more to get them out of the higher-rated classes and into the lower-rated classes.

Interested in learning more? Click the video below to learn how to understand classifications for workers’ comp dual wage.

What is a Dual Wage Classification?

There are several classifications in The Workers’ Compensation Insurance Rating Bureau of California® (WCIRB) for workers’ compensation.

These tiers classify employees within a category into two levels. Either:

- An apprentice, or

- A journeyman

An apprentice is essentially a beginner in the field whereas a journeyman knows their trade.

Using actuarial data for losses, the WCIRB found that journeymen, those who know their trade, have fewer injuries—so they give them credits.

The Apprentice Classification

The apprentice wage, or lower wage, pays more per hundred dollars than the journeyman for workers’ compensation because lower-wage workers have the most claims.

Why? Simply put, they have less experience. An apprentice is more likely to hit their finger with a hammer than someone a journeyman who has been in the role for 20 years, for instance.

The Journeyman Classification

Journeyman wages, or the high wage, receive credits and therefore, pay less per hundred dollars for workers’ compensation coverage.

Why Was Dual Wage Classification Created?

The dual wage system was created, in the highest risk classes of construction, in order to avoid penalizing the entire group of construction.

Workers who are experienced journeymen are charged less for workers’ compensation per every hundred dollars than workers who are newer to the industry.

In short, the dual wage is based on their wages.

Dual Wage is Increasing

The WCIRB has suggested levels over time on where the split is that delineates who’s an apprentice vs. a journeyman.

These levels have gone up over the years. In fact, most dual wage will increase by dollar $2 every two years.

There are 16 classes in the construction area which move back and forth. Some of them haven’t moved since 2018. For instance, for roofing, their split level is at $27 and has been that way since 2018.

Others move every couple of years. Carpentry, for example, was $35 in 2021. Now, in 2022, it’s increased to $39.

That’s a big jump! That’s $4 to move someone into the journeyman wage.

How Does a Business Owner Save Money on Their Workers’ Compensation Insurance?

So, how do you combat these raises? Risk mitigation. This includes:

- Managing your experience modification rating (essentially the number that the WCIRB gives you to grade you for losses)

- Maintaining a safe workplace

- Supporting mental health awareness to reduce burnout

- Emphasizing proper employee training

- Developing and distributing an employee handbook and code of ethics policy

- Implementing a handbook auditing procedure

Interested in learning more? Read on in our article “Insurance Trends in 2022: What to Watch For.”