Top Tips to Recession-Proof Your Business

Over the past several months, most business owners, and individuals alike, have heard mutterings about a recession.

Although we in no way can predict what’s coming, at Competitive Edge Insurance, we thought it’d be helpful to provide business owners with the top three tips they can take to recession-proof their businesses.

Let’s dive in; first, with an overview of what’s going on.

What Is Going On?

Many Americans might already be feeling the heat with decades-high inflation, record gas prices, and hefty grocery bills.

Bloomberg Economics says there’s close to a 75% probability there will be a recession by the start of 2024.

But how did this happen? And what is a recession?

What Is a Recession?

A recession, as defined by the National Bureau of Economic Research (NBER), is a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

This period of time is when the economy contracts and business activity slows down. This can be caused by a number of factors, including a:

- decrease in consumer spending

- increase in taxes

- decrease in government spending

- natural disaster

Businesses typically suffer during a recession, as there is less money circulating and people are more likely to save rather than spend. This can lead to layoffs, closures, and decreased profits.

As a business owner, it is important to recession-proof your business as much as possible. This means taking steps to ensure that your business can weather a recession and still remain profitable.

Contributing Factors

There are many contributing factors that have led the U.S. economy to tip its way toward a recession—inflation, supply chain issues, a nationwide labor shortage, the list goes on.

Moreover, The Washington Post notes that the Federal Reserve’s efforts to temper demand and tame prices have also been a contributing factor.

Oracle writes that “since 1950, recessions have lasted between two and 18 months.” This period can be “stressful for business owners, since they don’t know how long it will last. A business can freefall without an end in sight — if it isn’t ready.”

So let us help you prepare.

How Can You Recession-Proof Your Business?

There are many things you can do to recession-proof your business. For example, business owners can create a business emergency fund, assess their risk tolerance, reduce overhead, and more.

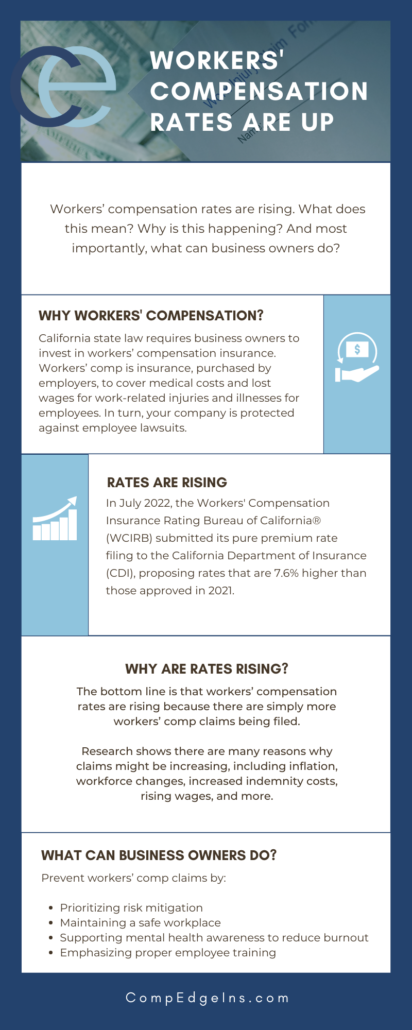

Minimize Workers’ Compensation Claims

One thing you don’t want in the midst of, or prior to a recession, is workers’ compensation claims being filed against your business. Why? It’s expensive.

Employers face both direct and indirect costs when a workers’ comp claim is filed.

Most obviously, when an employee is out on workers’ compensation, a business owner essentially “loses” their work. You then have to pay for another employee to pick up the slack (overtime in some cases), which can be costly.

Additionally, workers’ compensation claims can:

- Increase your insurance premiums

- Damage your public reputation, and

- In some cases, a business can be penalized up to $136,532 per person by the Occupational Safety and Health Administration (OSHA) for repeated or willful violations

(Yikes, that’s a lot of money!)

This considered, it’s crucial (especially during this time of teetering toward a recession) to do everything you can to make your workplace safe, and therefore, reduce workers’ compensation claims.

Interested in learning how workers’ compensation plays out for remote workers? Read our article “What Does Workers’ Comp Look Like for Remote Employees?”

Create Trust and Safety Among Employees

Significant layoffs can already be observed across the nation. This considered, a recession can be an especially scary time for your employees.

During this time, as a business owner, it’s especially important to create trust and safety among your employees. Consider doing the following to build employee retention:

- Keeping an open, honest line of communication

- Listening to your employees

- Utilizing employee engagement data

- Offering consistent and effective feedback

- Recognizing a job well done

- Not letting team building fall to the wayside

- Encouraging health and wellness and work-life balance

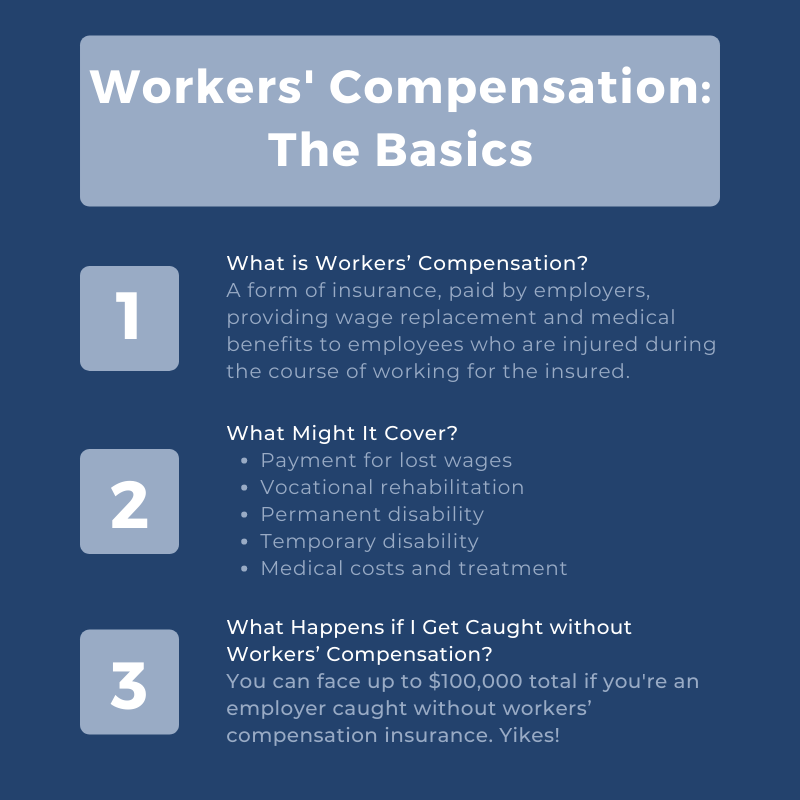

Invest in Insurance

The last thing you want during a recession is to get hit without the proper insurance. Typically, business profit is already top-of-mind during a recession.

If a cyber attack occurs, you receive high levels of workers’ comp claims, or an injury takes place on your commercial property, you want to be sure that you have the right insurance in place to keep your business financially protected.

Without proper insurance, a business owner may have to pay out-of-pocket for costly damages and legal claims against their company.

Additional Steps to Help

Minimizing workers’ comp claims, creating trust and safety among employees and investing in insurance are our top three tips, but there are so many other steps that you can take to help your business during a recession, such as:

1. Diversify your revenue streams

Don’t rely on just one source of income. If possible, try to have multiple, different streams of revenue coming in. That way, if one or two of them dry up, you’ll still have money coming in from the others.

2. Cut costs where you can

During a recession, every penny counts. Take a close look at your budget and see where you can cut costs. Even small savings can add up over time and make a big difference.

3. Build up your cash reserves

Having a healthy cash reserve is always a good idea, but it’s especially important during a recession. This will help you weather any tough times and keep your business afloat.

4. Focus on customer retention

During a recession, it’s more important than ever to hang onto your existing customers. Keep them happy and they’ll stick with you, even when times are tough.

5. Invest in marketing

Marketing is vital for any business, but it’s especially important during a recession. Why? Because that’s when people are scaling back their spending and being more particular about where they spend their money. If you want to stay top of mind, you need to keep marketing.

Keep Your Eye On the Prize

It’s easy to get discouraged during a recession, but it’s important to remember why you’re in business in the first place. Stay focused on your goals and don’t let tough times get in the way of your long-term success.

As a business owner, recession-proofing your company is vital to ensuring that success.

Interested in learning more about how to keep your business safe? Read on to find out what types of insurance your business needs during a recession.