Understanding the Basics of Workers’ Compensation

Workers’ compensation is an important part of business for any employer. Having workers’ compensation insurance helps protect both employers and employees, and is required by most states.

Workers’ compensation insurance can help recover an employee’s lost wages while they recover from a work-related injury or illness or even support family members if an employee is killed in a work-related accident. This type of insurance can be complex, so we’re here to help you in this article: “Understanding the Basics of Workers’ Compensation.”

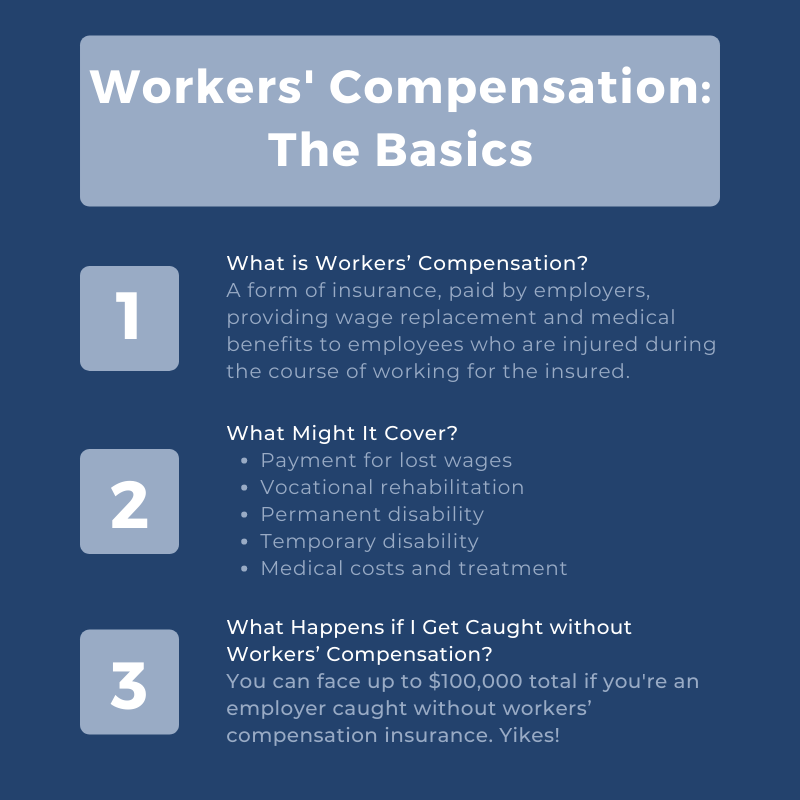

What is Workers’ Compensation?

“Workers’ compensation is a form of insurance, paid by employers, providing wage replacement and medical benefits to employees who are injured during the course of working for the insured.”

These wages and benefits are provided in exchange for eliminating the employee’s right to file a lawsuit against their employer’s negligence.

Workers’ compensation benefits are designed to help employees if they are unable to work, cover medical expenses, as well as other expenses and rehabilitation costs associated with disability or illness. As you look to explore workers’ compensation options, it’s important to look for one that provides adequate coverage and compensation for your employees.

What Does Workers’ Compensation Cover?

Specific workers’ compensation coverage laws vary depending on your state. The most common compensation requires workplace injury insurance to include:

- Payment for lost wages

- Vocational rehabilitation

- Permanent disability

- Temporary disability

- Medical costs and treatment

Who is Required to Purchase Workers’ Compensation Insurance?

Does every business need to purchase workers’ compensation insurance? The need for insurance falls on a state-by-state basis.

In California, for example, “all employers must provide workers’ compensation benefits to their employees under California Labor Code Section 3700. If a business employs one or more employees, then it must satisfy the requirement of the law,” according to the California Department of Industrial Relations.

“State rules are typically based on the type of business entity you have (sole-proprietorship, partnership, LLC, corporation) and your total number of part-time and full-time employees. In most states, one or more employee will trigger coverage requirements,” according to Workers Compensation Shop.

Does My Small Business Need Workers’ Compensation?

Short answer? Most likely. Insureon tells us that for almost all businesses in the United States, workers’ compensation insurance isn’t optional.

“Small businesses typically need a policy in place as soon as they hire their first employee. Even when not required by law, this policy provides important protection against medical expenses and employee lawsuits related to workplace injuries.”

Don’t worry—Competitive Edge can help your small business find insurance.

If I Am a Contractor, Do I Need Workers’ Compensation?

When you’re a contractor, your work can take you anywhere! This is exciting, but also opens up a window of opportunity for injury or illness—which is a much heavier financial burden to carry when you’re flying solo.

Think about what an injury on the job might mean for your future or work. By investing in workers’ compensation, you can protect yourself from the exciting, but risky unknown that lies ahead.

For more on workers’ compensation for independent contractors, please read on here.

Why Is Everyone Talking About Workers’ Compensation Now?

With the arrival of COVID-19, many people wondered if the contraction of COVID-19, and thereafter the time necessary to quarantine at home, was compensable under state workers compensation acts.

The answer to that question still remains unclear but is a topic of discussion.

According to the National Council on Compensation Insurance (NCCI), “workers compensation laws provide compensation for ‘occupational diseases’ that arise out of and in the course of employment, many state statutes exclude ‘ordinary diseases of life’ (e.g., the common cold or flu).

“There are occupational groups that arguably would have a higher probability for exposure such as healthcare workers. However, even in those cases, there may be uncertainty as to whether the disease is compensable.”

Where Can I Get Workers’ Compensation Insurance?

From the State Compensation Insurance Fund (State Fund) or a licensed insurance company. In some cases, employers might be able to self-insure.

How Much Does Workers’ Compensation Insurance Cost?

The fast and hard answer: It depends! Rates can vary from carrier to carrier and from state to state. By comparing rates and working with a trusted insurance professional, like our team at Competitive Edge, you can find a carrier that best fits your needs.

Although cost is a big factor to consider, it’s also important to look at:

- Services provided

- What industry the carrier is in

- Access to doctors

- Access to the claims adjusters

What Happens if I Get Caught without Workers’ Compensation?

For employers who think the money saved by not investing in workers’ compensation is worth it, perhaps it would be beneficial to detail the extreme consequences of not having workers’ compensation.

Failing to have workers’ compensation is a criminal offense.

In fact, section 3700.5 of the California Labor Code makes it “punishable by either a fine of not less than $10,000 or imprisonment in the county jail for up to one year, or both.”

“Uninsured employers can be levied a fine of $10,000 per employee on the payroll at the time of injury if the worker’s case was found to be compensable, or $2,000 per employee on the payroll at the time of injury if the worker’s case was non-compensable, up to a maximum of $100,000.”

The bottom line: You can face up to $100,000 total if you are an employer who is caught without workers’ compensation insurance!

Employers who claim to have been “unaware” of the need for holding workers’ compensation insurance still face the consequences. Although obtaining workers’ compensation can be expensive, especially for those employers who frequently have claims made against them, there is no “savings” worth not having workers’ compensation insurance.

At Competitive Edge Insurance, we believe the first step is for your business to show us under the hood so we can help build your case to the carrier to get the right coverage at the best price based on your real-world conditions.

For more on how to prepare for employee claims and what you need to know about workers’ compensation for independent contractors, please read on here.