Multifamily Property Owners, What’s Next?

In 2020, the multifamily real estate industry hit more than a few challenges—including rental applications dropping 10% overall. During this time, multifamily property owners needed to think creatively about ways to transform these numbers.

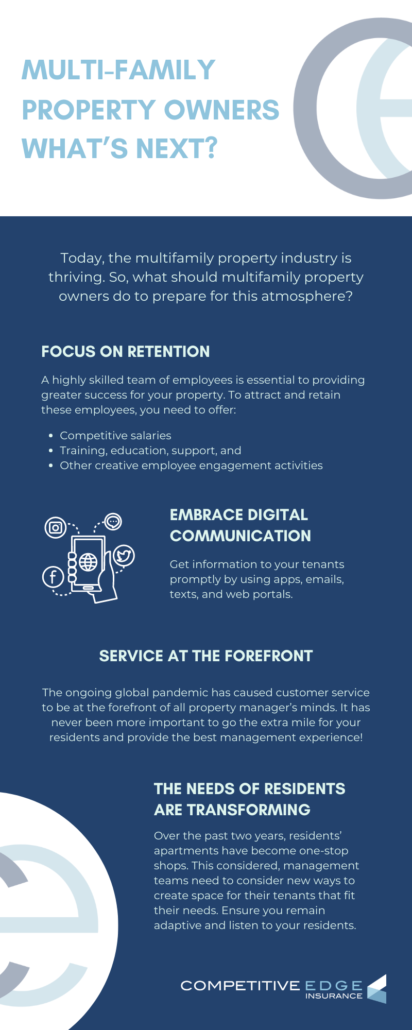

Today, the multifamily property industry is thriving. It’s a great place to deploy capital for those looking for stable returns and a hedge against inflation. Moreover, CBRE reports that multifamily construction will remain elevated as well as high occupancy levels.

So, what should multifamily property owners do to maintain this thriving atmosphere? Let’s discuss.

FOCUS ON RETENTION

Currently, there is an excess of demand for highly skilled employees, as there is a surplus of multifamily opportunities. A highly skilled team of employees is essential to providing greater success for your property.

To attract and retain these employees, you need to offer a few things, including:

- Competitive salaries

- Training, education, support, and

- Other creative employee engagement activities (like appreciation days, flexible work hours, and other fun office events!)

When you have a capable and professional team managing your tenants, it leads to greater resident satisfaction and long-term resident retention.

DON’T SHY AWAY FROM DIGITAL COMMUNICATION

Although many of us have had it with Zoom, don’t completely write digital communication off of your list!

Increased information and communication are especially essential to your success. It has become easier than ever to transition to digital forms of communication.

Get information to your tenants promptly by using tools like:

- Apps

- Emails, and

- Texts

(See, it doesn’t only need to be Zoom!)

If you haven’t already, you might also consider implementing a web portal.

Web portals allow residents to:

- Make payments

- Submit maintenance requests

- Review upcoming events, and

- Participate in resident discussion boards

Self-guided and virtual tours will also live in your web portal and are essential to providing options for potential prospects to view properties.

SERVICE SHOULD BE AT THE FOREFRONT OF EVERYTHING YOU DO

The ongoing global pandemic has caused customer service to be at the forefront of all property manager’s minds. Good service will help demonstrate value and increase satisfaction within your property.

Timely and efficient communication is key. To ensure your residents remain happy, you should also consider accelerating response times and prioritizing maintenance requests. It has never been more important to go the extra mile for your residents and provide the best possible management experience!

THE NEEDS OF RESIDENTS ARE TRANSFORMING

Over the past two years, residents’ apartments have become one-stop-shops: Offices, gyms, and sleeping quarters all in one. This need for multi-purpose space has caused residents’ immediate needs to change.

Property management teams need to consider new ways to create space for their tenants that fit their needs.

This may mean providing access to better high-speed internet, offering reservation-based conference rooms, or establishing outdoor wellness spaces.

Ensure you remain adaptive and listen to your residents. After all, resident feedback provides great insight on how to improve experiences, which can result in increased retention and satisfaction.

ECONOMIC UNCERTAINTY REMAINS

Over the past two years, recent changes in income and employment status have brought economic uncertainty for many residents; delinquency remains top-of-mind for commercial property owners.

This considered, it’s important to prepare for the risk of increased delinquencies.

As multifamily property owners look to the future, it’s important to understand what may come. There are a few ways you can remain proactive in your approach to the coming year. It’s also extremely important to ensure you remain risk-free.

Interested in learning more? Read on for our article “Property Investors: Risk Guide.”