Tag Archive for: risk profile

How to Measure Your Company’s Cybersecurity Risk

in Cyber Insurance, NewsWith the increase of cyber attacks on the rise, companies every day worry they will become the next victim. According to Cybersecurity Ventures, the number of cyberattacks has nearly doubled since 2019 and quadrupled since 2016 — with a cyberattack incident occurring every 11 seconds in 2021.

At Competitive Edge, we believe all businesses are vulnerable to cybercrimes, not only large tech corporations. Global cybercrime losses are estimated at $400 billion per year. But not to fret — there are preventative measures your company can take, starting with learning how to measure your company’s cybersecurity risk.

Be Weary of Third-Party Risk

According to a recent study, 59% of companies experience a breach because of a vendor or third party. Although most companies have a variety of security regulations in place, many still fall susceptible to third-party or vendor risk.

The biggest challenge considering third-party risk is gaining real-time data. For example, most companies evaluate third-party risk through an assortment of questionnaires, assessments, or tests. This assortment of data gathering makes it difficult to see beyond just the snippet of information provided, and beyond into the ever-changing terrain of cybersecurity risk.

We recommended evaluating and refreshing what cybersecurity metrics and Key Performance Indicators (KPIs) your company is currently tracking. There are many tools that can help evaluate third parties’ risk prior to onboarding—but the diligence shouldn’t stop there. Continue to monitor your third parties and vendors even after they’ve onboarded to ensure they are upholding best safety practices.

Don’t let third-party risk slip through the cracks!

Define your Company’s Strategy for Measuring and Communicating Risk

Data, data, and more data! When it comes to analyzing cybersecurity risk, it can be difficult to know where to focus your efforts. Risk-based reporting, however, is your best bet. Risk-based reporting, “as opposed to comprehensive, compliance-based, or incident-based reporting… is the approach best suited to reducing your organization’s exposure to cyber threats,” according to BitSight.

Risk-based reporting focuses on the big picture—not the small blips—and forces you to use context to deliver reports, delving into data concerning:

- “Past performance

- Risk concentration

- Industry benchmarks

- Financial quantification

- Cybersecurity frameworks”

Furthermore, the phrase, “stay in your own lane,” does not apply to companies when measuring cybersecurity risk! In fact, we recommend you look to your competitors to gain further context on your own stance in terms of cybersecurity risk. By measuring your own risk in comparison to similar companies or competitors, you might take more pointed action about where your team’s focus is needed to stay safe.

Make Your Data Digestible

Now, you’ve done all the work, but how can you make it clear and easy to understand? Security ratings are the most widely used and understood language when delving into cybersecurity risk. Ensure that all company team members understand the data and what efforts will be made as a result to combat the risk and why.

Measures You Can Take to Stay Secure

The consequences of poor cybersecurity are catastrophic. Geospatial World says, “The best cybersecurity strategies are ones that are proactive in nature. Being able to respond to and recover from an instance of hacking is important, but stopping the incident before it even starts is what saves your organization more time, money, and pain in the long run.” To avoid these consequences, Competitive Edge recommends you:

- Keep a tight rein on who has access to company information

- Conduct employee background checks

- Create individual accounts for employees

- Of course, not only to have strict cybersecurity policies, procedures, and practices but to enforce them

Cybersecurity is the type of threat you don’t want to put off dealing with until it’s too late. That’s where we come in! Talk to our experts at Competitive Edge today to measure your company’s cybersecurity risk and see how you can obtain proper coverage.

Don’t risk it.

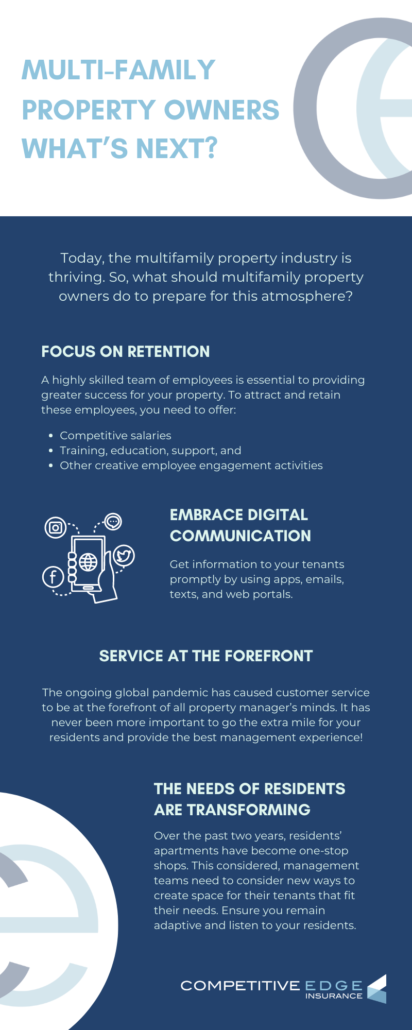

Multifamily Property Owners, What’s Next?

in NewsIn 2020, the multifamily real estate industry hit more than a few challenges—including rental applications dropping 10% overall. During this time, multifamily property owners needed to think creatively about ways to transform these numbers.

Today, the multifamily property industry is thriving. It’s a great place to deploy capital for those looking for stable returns and a hedge against inflation. Moreover, CBRE reports that multifamily construction will remain elevated as well as high occupancy levels.

So, what should multifamily property owners do to maintain this thriving atmosphere? Let’s discuss.

FOCUS ON RETENTION

Currently, there is an excess of demand for highly skilled employees, as there is a surplus of multifamily opportunities. A highly skilled team of employees is essential to providing greater success for your property.

To attract and retain these employees, you need to offer a few things, including:

- Competitive salaries

- Training, education, support, and

- Other creative employee engagement activities (like appreciation days, flexible work hours, and other fun office events!)

When you have a capable and professional team managing your tenants, it leads to greater resident satisfaction and long-term resident retention.

DON’T SHY AWAY FROM DIGITAL COMMUNICATION

Although many of us have had it with Zoom, don’t completely write digital communication off of your list!

Increased information and communication are especially essential to your success. It has become easier than ever to transition to digital forms of communication.

Get information to your tenants promptly by using tools like:

- Apps

- Emails, and

- Texts

(See, it doesn’t only need to be Zoom!)

If you haven’t already, you might also consider implementing a web portal.

Web portals allow residents to:

- Make payments

- Submit maintenance requests

- Review upcoming events, and

- Participate in resident discussion boards

Self-guided and virtual tours will also live in your web portal and are essential to providing options for potential prospects to view properties.

SERVICE SHOULD BE AT THE FOREFRONT OF EVERYTHING YOU DO

The ongoing global pandemic has caused customer service to be at the forefront of all property manager’s minds. Good service will help demonstrate value and increase satisfaction within your property.

Timely and efficient communication is key. To ensure your residents remain happy, you should also consider accelerating response times and prioritizing maintenance requests. It has never been more important to go the extra mile for your residents and provide the best possible management experience!

THE NEEDS OF RESIDENTS ARE TRANSFORMING

Over the past two years, residents’ apartments have become one-stop-shops: Offices, gyms, and sleeping quarters all in one. This need for multi-purpose space has caused residents’ immediate needs to change.

Property management teams need to consider new ways to create space for their tenants that fit their needs.

This may mean providing access to better high-speed internet, offering reservation-based conference rooms, or establishing outdoor wellness spaces.

Ensure you remain adaptive and listen to your residents. After all, resident feedback provides great insight on how to improve experiences, which can result in increased retention and satisfaction.

ECONOMIC UNCERTAINTY REMAINS

Over the past two years, recent changes in income and employment status have brought economic uncertainty for many residents; delinquency remains top-of-mind for commercial property owners.

This considered, it’s important to prepare for the risk of increased delinquencies.

As multifamily property owners look to the future, it’s important to understand what may come. There are a few ways you can remain proactive in your approach to the coming year. It’s also extremely important to ensure you remain risk-free.

Interested in learning more? Read on for our article “Property Investors: Risk Guide.”