Workers’ Compensation and EPLI Claims Are Rising: What Does This Mean?

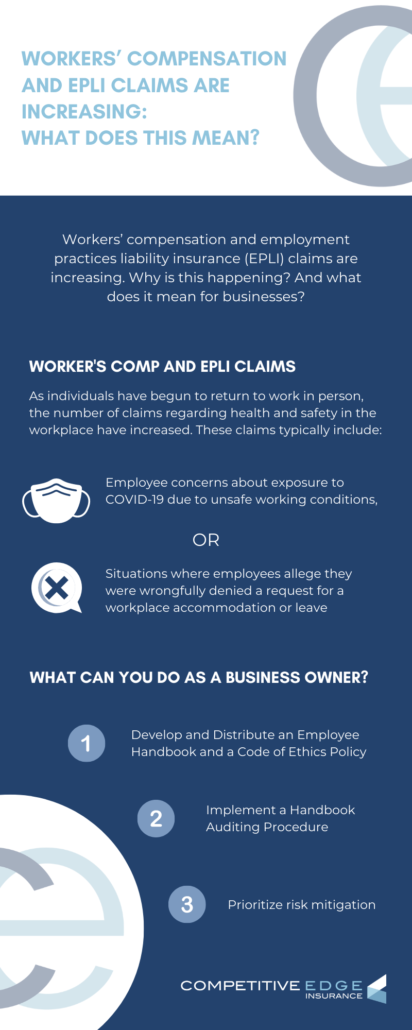

Workers’ compensation and employment practices liability insurance (EPLI) claims are increasing across the board. Why is this happening? And what does it mean for businesses?

Let’s discuss.

Workers’ Compensation and EPLI: Defined

Briefly, before diving in, we want to make sure that readers are familiar with both workers’ compensation and EPLI. Below is an abbreviated definition of each.

Workers’ Compensation Insurance

Workers’ compensation is insurance, paid by an employer. This coverage provides wage replacement and medical benefits to employees who are injured during while working for the insured.

Wages and benefits are provided in exchange for eliminating the employee’s right to file a lawsuit against their employer’s negligence, and can help pay for:

- Lost wages

- Medical expenses

- Rehabilitation costs

- And more

Read on to understand the basics of workers’ compensation.

Employment Practices Liability Insurance

Employment practices liability insurance (EPLI) “provides coverage to employers against claims made by employees.” Policies typically extend coverage to the following:

- Wrongful Termination

- Sexual Harassment

- Wage-Related Claims

- Claims of Unequal or Unfair Pay

- Discrimination Claims (i.e. age, race, gender, sexual orientation)

- Third-Party Claims

For more information, read our EPLI article.

A Background on Workers’ Compensation and EPLI Claims

Over the past two years, the number of both workers’ compensation and EPLI claims have increased. In fact, research from the Equal Employment Opportunity Commission (EEOC) shows that EPLI claims have increased annually since 2003, with 37,632 workplace retaliation claims filed in 2020.

Moreover, as individuals have begun to return to work in person, the number of claims regarding health and safety in the workplace have increased as well. These claims typically include:

- Employee concerns about exposure to COVID-19 due to unsafe working conditions, or

- Situations where employees allege they were wrongfully denied a request for a workplace accommodation or leave

What Can You Do as a Business Owner?

So, with this rise in claims, what can you do to protect yourself as a business owner? You can prevent workers’ comp and EPLI claims by:

- Developing and Distributing an Employee Handbook

- Developing and Distributing a Code of Ethics Policy

- Implementing a Handbook Auditing Procedure

- Prioritizing risk mitigation

Interested in learning more about risk mitigation? Read on in our article “Risk Mitigation: What Is It and How Can You Do It?”