Cannabis Insurance: Risks and Coverage

The emerging cannabis market has created a new space for industry coverage. There are, however, both general and unique risks of cannabis insurance that shouldn’t be overlooked.

Let’s talk about the risks of cannabis insurance and what coverage is available to keep your business protected.

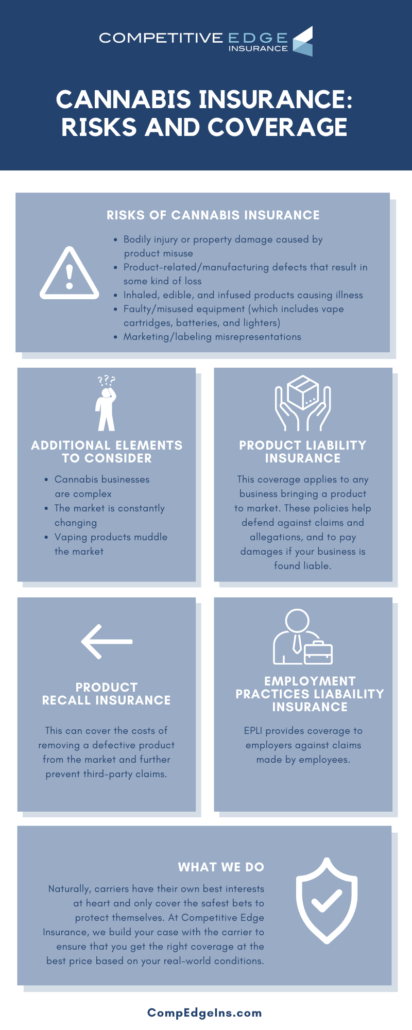

Risks of Cannabis Insurance

Claims can vary, but some of the most common in the cannabis industry include:

- Bodily injury or property damage caused by a product misuse

- Product-related/manufacturing defects that result in some kind of loss

- Inhaled, edible, and infused products that may have caused illness

- Faulty/misused equipment (which includes vape cartridges, batteries, and lighters)

- Marketing/labeling misrepresentations

Moreover, The National Association of Insurance (NAIC) acknowledges that companies might need to reevaluate their coverage when it comes to cannabis and hemp. With the rising popularity of different forms of cannabis (for example, edibles), there are mental effects that need to be accounted for with insurance risk.

NAIC claims that products like edibles “increase the risk of product liability and safety recalls. The psychoactive effects of CBD raise the risk that products may be deemed mislabeled, misrepresented, or harmful.”

Research shows that young people have shown more interest in illicit drug use in recent years, which could change the insurance services and risks available.

Some additional and unique risks associated with cannabis coverage to consider include:

- Cannabis businesses are complex

- The market is constantly changing

- Policies are not on the same playing field

- Vaping products muddle the market

What Insurance Does Your Cannabis Business Need?

So, what insurance does your cannabis need to combat these risks? Below are three of the best ways to protect your cannabis business.

- Product Liability Insurance

Cannabis and CBD products require custom product liability policies for their:

- Manufacturers

- Retailers

- Distributors

- Cultivation

- Facilities

- And more

This coverage applies to any business bringing a product to market. If an incident were to occur, these custom product liability policies kick in to help defend your company against claims and allegations and to pay damages if your business is found liable.

Considering the potential claims that can be made against your business (listed under “Risks of Cannabis Insurance”), product liability insurance is an essential part of your cannabis coverage.

- Product Recall Insurance

Similarly, you may want to consider product recall insurance, which can cover the costs of removing a defective product from the market and further prevent third-party claims.

- Employment Practices Liability Insurance (EPLI)

Lastly, your cannabis business might consider EPLI.

Employment Practices Liability Insurance (EPLI) is insurance that provides coverage to employers against claims made by employees.

EPLI policies typically extend coverage to the following:

- Wrongful Termination

- Sexual Harassment

- Wage-Related Claims

- Claims of Unequal or Unfair Pay

- Discrimination Claims (i.e. age, race, gender, sexual orientation)

- Third-Party Claims

- And more

According to Amtrust Financial, the below are also common employer missteps that may be covered:

- Failure to Hire or Promote

- Libel, Slander, Defamation of Character, or Invasion of Privacy

- Wrongful Infliction of Emotional Distress

- Wrongful Discipline or Demotion

Who Needs EPLI?

The fact of the matter is that some industries are more susceptible to these types of claims than others. Highly susceptible industries include the cannabis industry as well as healthcare, professional services, restaurant, food services, retail, and manufacturing.

Again, EPLI claims can be detrimental to businesses of all sizes and types. This policy helps protect against many kinds of employee lawsuits which is why it’s important to invest in coverage, especially for a client-facing business such as cannabis.

A Final Word

Naturally, carriers have their own best interests at heart and only cover the safest bets to protect themselves. At Competitive Edge Insurance, we build your case with the carrier to ensure that you get the right coverage at the best price based on your real-world conditions.

Read on if you’re wondering the difference between cannabis and hemp insurance, then get in touch with our team today.