What to Know About Changes in Cannabis Insurance

The cannabis industry continues to grow every day. With this, comes a new space for industry coverage. In this article, we’ll discuss changes in cannabis insurance; including how the industry has evolved, cannabis business insurance challenges, and how to insure your high-risk business properly. Let’s dive in.

How Has the Cannabis Industry Evolved?

As we previously mentioned, the public’s reaction to cannabis has shifted time and time again throughout history. Even just ten years ago, one might’ve laughed if you told them that in 2020, cannabis sales would hit an all-time record of $17.5 billion. In fact, from just 2019 to 2020, the industry experienced a 46% increase in sales, according to Forbes.

To put things in perspective, according to PropertyCasualty360, cannabis sales may reach up to $37 billion by 2024, which means “the U.S. legal cannabis market would still outpace annual craft beer sales and generate more revenue than toothpaste, hard seltzer, and the NBA combined.”

The decision of many U.S. states to have made cannabis legal today is still controversial on some level.

While many people turned their noses up at cannabis being made legal, it’s interesting to remember that the drug actually “enjoyed a 5000 year history as a therapeutic agent across many cultures,” until the Marijuana Tax Act of 1937, which prohibited its use and sale.

The cannabis industry continues to evolve every day.

With the now booming cannabis market, comes a new space for industry coverage. There are unique cannabis business challenges, which we will discuss below. If you’re interested, however, in the difference between cannabis and hemp insurance, read on here.

Challenges with Cannabis Insurance

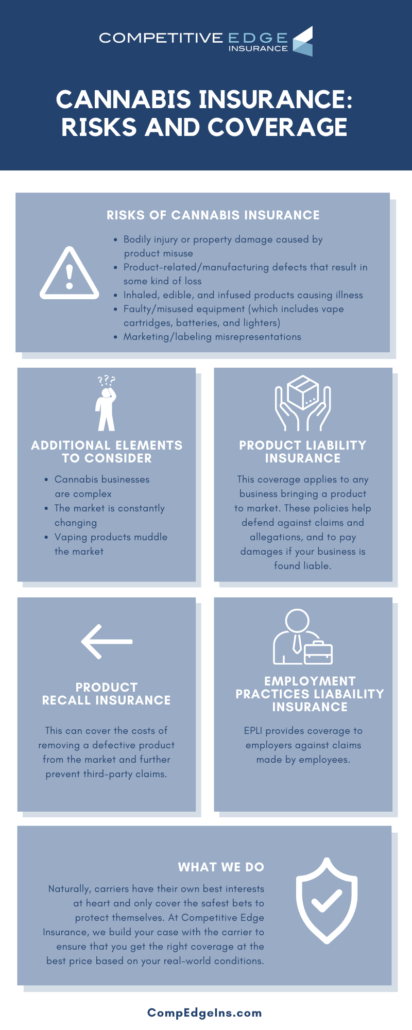

One particular challenge of the emerging cannabis industry is properly insuring your cannabis business. According to Yahoo Finance, cannabis insurance “help[s] strengthen and legitimize marijuana-focused businesses. It protects them against:

- Crime

- Vandalism

- Property damage

- Other unfortunate events”

Insurance is essential to protecting any cannabis company as it minimizes liability and risk exposure. But that doesn’t mean it’s easy to find the right coverage.

“The good news is the cannabis insurance industry has come a long way in a short time,” says Ian Stewart, founder and chair of the national cannabis and hemp law practice at Wilson Elser.

“These days it is not so much about whether companies can obtain coverage, but more about what lines are available and the limits,” says Stewart. “The variety of insurance vehicles is expanding.”

These varieties include:

- Property and casualty lines

- General commercial insurance

- Product liability

As the cannabis industry continues to grow, we gain a better understanding of how it works and it’s loss history.

More difficult coverage types to write for cannabis businesses, according to Stewart, include:

- Employment

- Cyber,

- Errors and Omissions (E&O) policies

- Specialty lines (i.e. crop coverage)

- Auto policies (for companies who deliver cannabis products)

How to Insure Your Cannabis Business

Cannabis insurance falls into the realm of high-risk insurance. According to PropertyCasualty360, “insurers that provide coverage to cannabis businesses engaged specifically in selling marijuana can be criminally liable for aiding and abetting in the sale of marijuana or conspiring to violate the CSA — even when the business’s activity is legal under state law. Further, intrastate issues may also cause complications if marijuana is not regulated uniformly within a state.”

For these reasons, it can be more difficult to find proper coverage.

Legal cannabis companies require specific cannabis insurance expertise. Since the industry is still blooming, there are not as many experts as one would yet hope for.

The most important part of insuring your cannabis business is working with a knowledgeable insurance provider, one who understands the specific needs of your high-risk business.

Depending on whether you’re a dispensary, cannabis manufacturer, cultivator, delivery business, physician, or so on, all of these branches face a different set of challenges, which, in turn, require different cannabis insurance policies.

These insurance policies, according to Embroker, might include:

- General Liability

- Product Liability

- Commercial Property

- Workers Compensation

- Business Income Coverage

- Cyber Liability

- Errors & Omissions and Technology E&O

- Crop Coverage

- Commercial Auto

- Cargo and Inland Marine

- Loss of Income

- The list goes on!

The steps to insuring your cannabis business can seem daunting. That’s why we recommend you enlist a trusted expert who has experience insuring this high-risk industry. This way, you can partner with someone who understands the specific needs of your cannabis business to create an effective risk management strategy.

Contact Brenda Jo and her team at Competitive Edge to learn more.