What Mandating the Vaccine Might Mean for Your Business Insurance

Business owners have experienced unforeseen challenges as a result of the last nearly two years in a global pandemic.

The conversation surrounding the ethics of requiring vaccines has been floating around the workplace for about just as long.

In September 2021, however, President Joe Biden directed the Occupational Safety and Health Administration (OSHA) to introduce an emergency temporary standard (ETS) that requires companies with 100 or more employees to ensure all employees are:

- Fully vaccinated

- Or, that they submit to weekly testing and mandatory masking

*As of November 17th, however, OSHA has paused all vaccine mandates “after a federal appeals court upheld a stay.”

Regardless, it is still top of mind for employees. Here’s what mandating the vaccine might mean for your business insurance along with how you can prepare if the mandate is passed.

Who Would This Mandate Affect?

According to The New York Times, companies with 100 or more employees would “have until Jan. 4 to ensure all their workers are either fully vaccinated or submit to weekly testing and mandatory masking.”

This measure would be enforced to promote workplace health and safety and will affect “some 84 million private-sector workers across the country, including some 31 million who are believed to be unvaccinated.”

If the mandate comes into play, OSHA anticipates the ETS will be in effect for six months depending on COVID-19 statistics.

When Did This Mandate Come About?

“The measure was announced by President Biden in September [2021], and details were released on Nov. 4 by the Labor Department’s Occupational Safety and Health Administration [OSHA],” according to The Times.

COVID, ELP, and EPLI

First things first, what is Employer’s Liability Insurance? This form of insurance “protects your business when an employee sues over a work injury or illness,” according to Insureon. It is especially important, considering “almost one in five small businesses will face employee litigation” at some point.

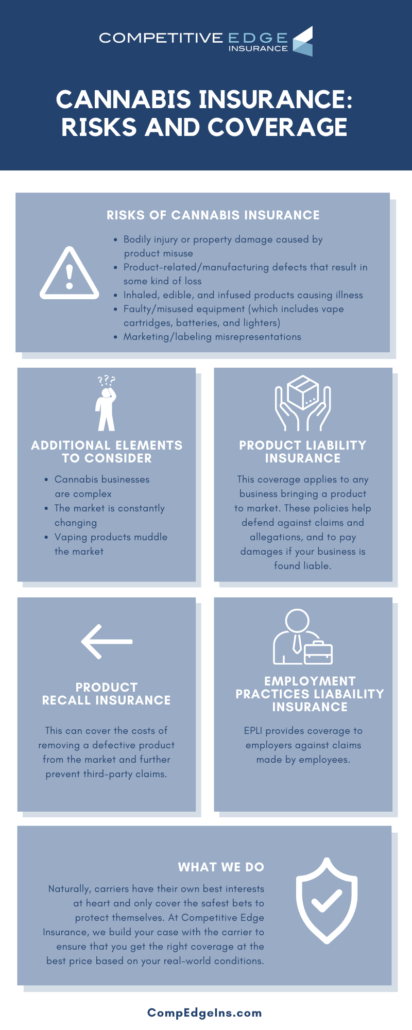

Equally as important to consider is Employment Practices Liability Insurance (EPLI), which is insurance that “provides coverage to employers against claims made by employees.”

With the potential vaccine mandate, we can anticipate an increase in EPLI claims. As a result, we might see EPLI premiums increase. Kyle Jeziorski, Executive Vice President at Founder Shield offered insight: “I think insurers will try to add COVID-19 exclusions to EPLI policies and potentially offer the coverage for an additional premium.”

It’s definitely something we here at Competitive Edge Insurance will continue to keep a pulse on.

How Responsible Are Businesses for the Spread of COVID?

During the onset of COVID, many employees wondered to what extent businesses and business owners should be held liable if an employee were to contract COVID-19 on the job and suffer sickness or even death as a result.

The answer today is still clear as mud.

There are, however, steps your business can (and should) take to prepare for these newly introduced COVID-19 vaccine mandates.

Steps Your Business Can Take to Prepare

Business Insurance tells us that now is the time that businesses should prepare U.S. Equal Employment Opportunity Commission processes as well as human resources (HR) departments for what lies ahead.

As we well know, there are many employees across the U.S. who will request exemptions from receiving the COVID-19 vaccine due to religious or health reasons. This process, called an ‘interactive process,’ can take weeks or even months.

For businesses, this can be a lot added on their plates—especially if they receive a high number of requested exemptions.

Businesses should know this ahead of time and prepare accordingly.

Erect a Framework in Advance

“Businesses owe it to themselves to put together a framework to manage this,” says Chuck Kable, Chief Legal Officer and Chief Human Resources Officer at Axiom Medical. “You have to have a protocol and a process that you have to administer consistently and over time, and you have to treat everybody equally.”

If businesses fail to do so, this is when liabilities begin to pop up.

“Any mishandling of an exemption request can run afoul of anti-discrimination laws,” says Adam Kempe of Kelley Kronenberg. Companies might face various liabilities including:

- Failure to maintain and keep private workers’ health information

- Failure to follow steps in Equal Employment Opportunity Commission (EEOC) exemption requests

Consider OSHA Fines

If the headache of one of your employees filing a claim with OSHA as a result of your negligence isn’t enough motivation to get your ducks in a line, consider the hefty OSHA fines you might face.

If a complaint is filed, the first thing OSHA is going to look for is your current OSHA Covid Protection Procedures that are in place, which includes your Injury and Illness Prevention Program (IIPP). All employers are required to have IIPPs in place.

OSHA fines can be especially detrimental to your company’s financials because while OSHA personnel might come in looking for one thing, chances are they will do some digging, which could lead to additional fines or penalties. OSHA, in that sense, is similar to the IRS—except for employers.

Employee Screenings

A final precaution that employers should take, according to Brenda Jo Robyn, founder of Competitive Edge Insurance, is to conduct thorough employee screenings.

Brenda Jo also acknowledges that it may be the case that many people will choose to not work as a result of this mandate.

“You can find out a lot about an employee or potential employee from a screening,” says Brenda Jo. “Be sure to look at their workers’ compensation claims and do reference checks.”

Take advantage of not only their most recent reference but reach out to prior references as well.

A Final Word

With this potential vaccine mandate firing up, it’s especially important for employers to be on their A-game as far as safety procedures and insurance are concerned.

“There’s nothing that prevents a company, especially one not familiar with these issues, from now bringing in appropriate HR personnel, a consultant, or employment counsel to understand what to expect,” says Kempe of Kelley Kronenberg.

On the topic of vaccines, did you know that Brenda Jo Robyn, founder of Competitive Edge, began her career as an Epidemiologist who specialized in immunizations? To hear more about vaccines, specifically, her passion for Polio research, visit this blog post.