Four Types of Insurance Coverage for your Business

There are so many options for insurance that it can be overwhelming to know which research steps to take as a business. At Competitive Edge, we help you navigate what coverage best fits you and your business.

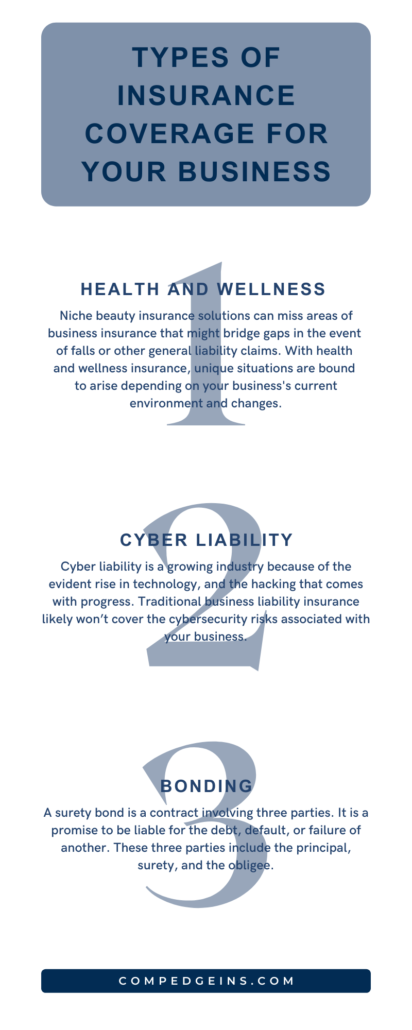

Health and Wellness

Niche beauty insurance solutions can miss areas of business insurance that might bridge gaps in the event of falls or other general liability claims. With health and wellness insurance, unique situations are bound to arise depending on your business’s current environment and changes.

The various Health and Wellness sectors that Competitive Edge caters to include:

- Beauty

- Spa Owners

- Hair Salon Owners

- Nail Salon Owners

- Fitness

- Yoga Studio Owners

- Pilates Studio Owners

- Dance, BarreFit, and Additional Exercise Studio Owners

- Martial Arts Studio Owners

- Health

- Naturopathy Practices

- Audiologists

- Speech and Occupational Therapy Centers

- Alternative Therapy Centers

- Acupuncturists

To provide you with the right coverage from the right carrier, we need to know about your business. It’s not enough to put all cosmetology companies in one box, all spas in another, and all beauty product companies in yet another pre-planned box.

Cyber Liability

Cyber liability is a growing industry because of the evident rise in technology, and the hacking that comes with progress.

Does this sound like news to you? Don’t worry—we already wrote an article here for you to read about reducing cybersecurity risk.

It’s important to understand what might be covered under your cyber insurance policy.

- Data Breaches

- Intellectual Property Rights

- System Failure

- Damages to a Third-Party System

- Cyber Extortion

- Business Interruption

Traditional business liability insurance likely won’t cover any cyver risks associated with your business.

Bonding

Surety bonds offer an important secondary level of coverage.

A surety bond is a contract involving three parties. It is a promise to be liable for the debt, default, or failure of another. These three parties include:

- The Principal: The party that purchases the bond and undertakes the obligation to perform the act as promised.

- The Surety: An insurance company that guarantees the obligation to be performed. If the principal fails to perform the act as promised, the surety has a contractual obligation for the losses.

- The Obligee: The party who requires and receives the benefit of the surety bond.

There are two categories of surety bonds: contract surety bonds and commercial surety bonds.

Contract surety bonds are typically written for construction projects. If a contractor defaults, the surety company is obligated to find another contractor to complete the contract. Another option for the surety company is to compensate the project owner for the financial loss incurred. There are a few bond types of contract surety bonds.

Contract sureties are required during a federal construction contract valued at $150,000 or more. State and municipal governments have similar regulations. Note that contract sureties may also be used with a private owner.

Commercial surety bonds, on the other hand, cover a broader range of surety bonds. These are required of individuals and businesses by federal, state, and local governments.

These bonds can be required by the government to obtain a license. For example, mortgage brokers, contractors, and auto dealers may be required to obtain a license or permit bond. These bonds can also be required to protect various statutes, regulations, ordinances, and other government entities.

General Business Insurance

General business insurance covers areas such as property damage, bodily injury, product liability, libel, slander, and copyright infringement.

Hindsight is no place for general business insurance conversations as lawsuits are a sad reality for many businesses. Just one bodily injury or property damage claim can take away everything you’ve worked so hard to build. General liability insurance provides businesses with coverage for most damages, injuries, medical costs, legal fees, and settlements in the case that you’re being sued.

Construction Insurance

Shock losses from large claims can make it difficult to get affordable insurance in the high-risk field of construction. If your insurance was canceled or non-renewed, we can help.

Our depth of experience and exemplary reputation with the carriers we work with can find a home for your hard-to-place and high-risk clients can find the right coverage. The fact is, every business can find coverage, you just have to take the time and know where to look.

The businesses we work with include:

- Roofing

- Construction

- Commercial Property

- Commercial Real Estate

- General Liability (CGL)

Errors and Omissions Insurance

In the CRE industry, agents are at higher risk of being accused of failing to meet a client’s expectations, failing to document decisions or actions, or failing to act in a customer’s best interest. This could be an error on a title or an oversight in a property listing, which could lead to a costly lawsuit.

Errors and Omissions (E&O) insurance covers against financial losses from lawsuits filed as a result of an agent’s work in the real estate profession. These policies cover liability related to the following issues:

The client may claim that you made an error that led to financial loss. In a lawsuit regarding professional mistakes, you may be at risk of losing big, considering the size of commercial property transactions.

An example of this is when a real estate agent misstates the square footage of a property. If the agent has Errors and Omissions Insurance, however, they may be covered for attorney’s fees, court costs, settlements, judgments, and fines.

Potential E&O Exclusions

While it’s important to know what E&O insurance covers, it’s also important to understand potential exclusions. Some common exclusions in E&O coverage include claims resulting from dishonest or criminal acts. As well as claims associated with a polluted property. If any agent causes bodily harm or death to another person, or the agent causes damage to someone’s property, their claims will not be covered under E&O insurance.

In the CRE industry, it’s more common to face a lawsuit related to errors and omissions so it’s best to be covered before you need it. Roger J. Stewart is an expert in providing coverage for real estate professionals and has helped various CRE investors and agents avoid risk and save money throughout the years.

At Competitive Edge Insurance, we work with insurance carriers across the country to place all types of business coverage. We are always seeking out new insurance companies to write hard-to-place and high-risk business insurance.

Don’t let cancellation dissuade you from finding comprehensive coverage, we can help!

Contact us today at Competitive Edge to find out more information.