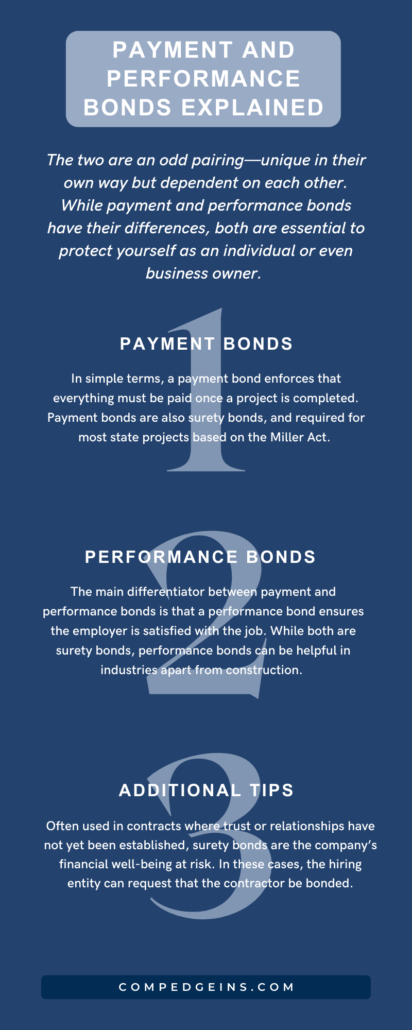

Payment and Performance Bonds Explained

Payment and performance bonds… The two are an odd pairing—unique in their own way yet dependent on each other.

Although payment and performance bonds have their differences, both are essential in protecting yourself in the world of insurance. Let’s explore the differences below.

Payment Bonds

What is a payment bond? Simply put, a payment bond guarantees payment for subcontractors and payment for materials once a project is completed.

Payment bonds are most commonly seen in construction. Payment bonds are a type of surety bond and are required for most state projects based on the Miller Act.

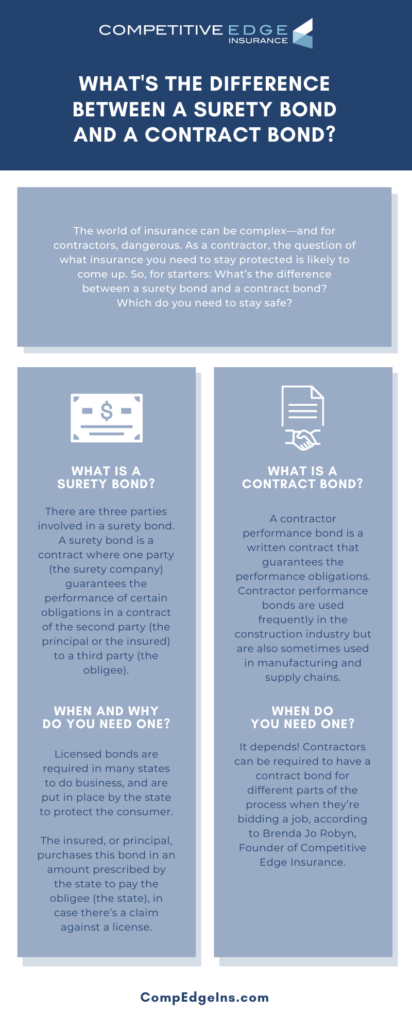

Surety Bonds

What is a surety bond?

A surety bond is a contract where one party (the surety company) guarantees the performance of certain obligations in a contract of the second party (the principal or the insured) to a third party (the obligee).

When Do You Need a Surety Bond?

Surety bonds are needed for most licenses in the state of California and other states as well. Some examples of who might need a surety bond include:

- Contractors

- Real estate companies and agents

- Financial institutions

- Janitorial staff

Why Do You Need a Surety Bond?

Licensed bonds are required in many states to do business and are put in place by the state to protect consumers.

The insured, or principal, purchases these bonds in an amount prescribed by the state to pay the obligee (the state), in case there’s a claim against somebody’s license.

The Miller Act

As previously mentioned, surety bonds are required for most state projects based on the Miller Act.

The Miller Act was passed by the U.S. General Services Administration Public Buildings Service (GSA) to explain how payment bonds protect subcontractors and suppliers.

The GSA responds to any reports of nonpayment, following the legal action needed and protected by the Miller Act.

The GSA states that “the Miller Act requires that prime contractors for the construction, alteration, or repair of Federal buildings furnish a payment bond for contracts in excess of $100,000.”

There are legal consequences for breaking a contract through the Miller Act.

The GSA expands: “Failure by a contractor to pay suppliers and subcontractors gives such suppliers and subcontractors the right to sue the contractor in the U.S. District Court in the name of the United States.”

Performance Bonds

The main difference between payment and performance bonds is that a performance bond ensures that the employer is satisfied with the job.

While both payment and performance bonds are surety bonds, performance bonds are visible in industries outside of construction.

A performance bond, according to Investopedia, “ensures the completion of a project.” A performance bond covers the ability of the contractor to perform and finish the job as per contract requirements.

If the contractor doesn’t perform, the contract bond kicks in and helps to pay for the completion of that performance.

A performance bond involves three parties:

- The principal: The primary contact in the performance bond; responsible for performing the contract

- The obligee: The person receiving the obligation

- The surety: Responsible for making sure each party complies with the performance bond obligations

A Final Note

If these bonds are used and there’s a claim on a bond, the contractor who purchased the bond has to pay that back.

This considered, surety companies look for strong financials in a company, including assets, lines of credit, and letters of credit.For more information, watch this video about surety bonds and contract bonds. There, Brenda Jo Robyn, founder of Competitive Edge, lays it all out on the table in a way that’s easy to understand.