Insurance Requirements for Business Owners

When it comes to protecting your business, insurance can get tricky. What policies do you need? How can you ensure you’re meeting insurance requirements given by a city, state, or government?

Don’t worry—Here we have Brenda Jo Robyn, Founder of Competitive Edge Insurance, on camera to discuss standard insurance requirements for business owners. Let’s dive in!

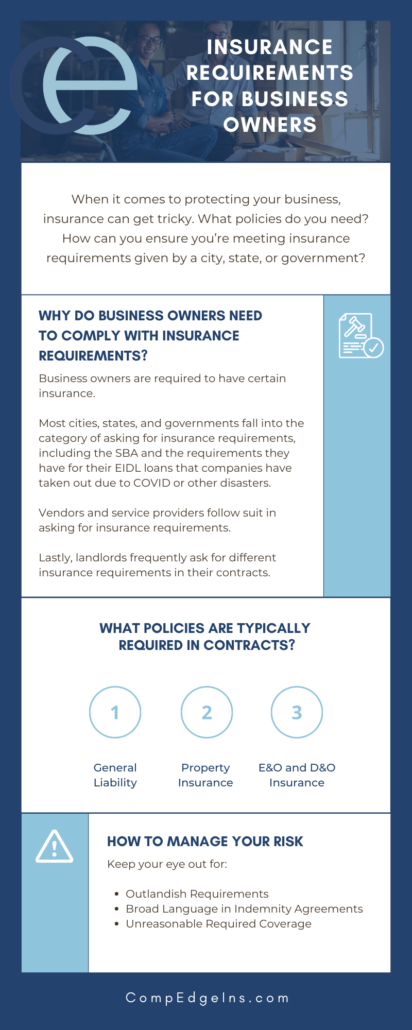

Why Do Business Owners Need to Comply with Insurance Requirements?

Business owners are required to have certain insurance.

Most cities, states, and governments fall into the category of asking for insurance requirements, including the SBA and the requirements they have for their EIDL loans that companies have taken out due to COVID or other disasters.

Vendors and service providers follow suit in asking for insurance requirements.

Lastly, as you might imagine, landlords frequently ask for different insurance requirements in their contracts. Anytime real property is part of a professional relationship, these requirements ensue.

What Policies Are Typically Required in Contracts?

Below is a general list of four policies you might see in a contract in terms of insurance requirements.

General Liability

The number one policy that’s required is general liability.

This type of insurance policy protects a third party in the event that there’s a bodily injury or property damage claim to your products or services that you provide for them.

General liability, for example, would also include this scenario: Let’s say you have someone come into your office (you’re either renting a space or the whole building). Then, this someone trips on your carpet and falls as they’re coming in.

General liability would be the number one policy to make sure that you have your requirements buttoned up.

Property Insurance

The next policy would be property insurance. If someone is renting their property to you, they want to ensure that it’s covered in case of a loss.

If you’re a restaurant, for example, you could imagine you’re in someone else’s building. You need to make sure not only that you have the safety elements in place (i.e. fire suppression) but also insurance for the owner of the building, should something happen.

Professional Errors and Omissions (E&O) Insurance

Professional errors and omission (E&O) insurance come into play when there’s a failure in services or technology that you might be providing. The policy will provide the company with a way to make the client whole after an error that results from this mishap or financial loss occurs.

Directors and Officers (D&O) Liability Insurance

Directors and officers (D&O) liability insurance might come into play for a business owner as well.

This type of policy is typically required by investors before they fund, and before becoming a board member. Remember, when you’re working with investors and funding, there’s a contract involved—so you’ll probably see this there.

How to Manage Your Risk as a Business Owner

So, now what do you do? Here comes the risk mitigation part.

A lot of times, you will see that most contracts ask for reasonable requirements—and it only makes sense they should have these protections in place.

We recommend, however, that you keep your eye out for these elements in order to best manage risk.

Outlandish Requirements

There are times, however, that you see outlandish requirements. Brenda Jo reminds us that these need to come up as a big red flag for you. An example of an outlandish requirement would be an unusually high minimum occurrence or aggregate limits or policies that are unrelated to the scope of the contract.

Broad Language in Indemnity Agreements

Look at broad language within the indemnity agreement that works in their favor, and not in yours. Moreover, there is such a thing as being too broad.

Remember, indemnity agreement language should always be reviewed by your attorney.

Unreasonable Required Coverage

This is a big one!

If you’re the party in the contract that the insurance requirements are being imposed upon—in construction, typically the contractor or subcontractor—it’s important to confirm that the required coverage terms are either included in your current insurance program or can be purchased at a reasonable price.

Ideally, you’ve had your broker review the contract before you sign it so that they can let you know what might be remiss in the requirements that are being put in front of you, and what you might need to purchase.

Then, is the purchase of new insurance more than what would be justified for this amount of a contract? For instance, if your contract is $25,000, and you’re required to purchase additional insurance for $5,000, does that make sense? Is this something that you can write out of the contract? Or, do you need to rework your bid?

Then, what level of insurance is necessary for each of the different policies? Do the policies make sense regarding the contract or the scope of work? For any new requirements or endorsements that need to be added, are they reasonable, and are they reasonably priced?

Interested in learning more? Read on to learn about complying with insurance requirements for construction, manufacturing, and tech start-ups.