Property Owners: What Commercial Insurance Do You Need?

As a commercial property owner, do you know what types of commercial insurance you need to keep yourself and your building protected? Let’s discuss the five types of coverage you should consider.

Five Types of Commercial Insurance Property Owners Need

At the minimum, there are five types of commercial insurance a property owner should be carrying.

Property Insurance

This one most likely came up as a no-brainer.

Commercial property insurance, according to Nationwide, protects “physical assets [i.e. building, equipment, tools, inventory, personal property, furniture] from fire, explosions, burst pipes, storms, theft, and vandalism.”

It’s good to note that natural disasters like earthquakes and floods aren’t typically included in commercial property insurance policies; however, they can be added to a policy.

So, how much will property insurance cost you? It depends. Some factors that might contribute to the premium you pay include:

- Location

- Building materials used to construct your property

- Industry

- Your building’s level of theft and fire protection

Liability Insurance

As a property owner, you also need liability insurance. This type of coverage protects against “claims resulting from injuries and damage to people and/or property [and] covers legal costs and payouts for which the insured party would be found liable,” according to Investopedia. Intentional damage, contractual liabilities, and criminal prosecution are not covered by liability insurance coverage.

Rent Loss Insurance and/or Business Interruption Insurance

Rent loss insurance, also known as fair rental value coverage, is for landlords and “covers a loss of rental income if your property becomes uninhabitable to a current tenant due to covered damages beyond your control.”

An example of this damage might include perhaps a tree falling on the roof of your property or a burst pipe.

Business interruption insurance, on the other hand, is coverage that can replace “business income lost in a disaster.” This disaster might include a fire or natural disaster.

Business interruption insurance, however, is sold as an add-on; not as a standalone policy.

Flood Insurance

Heavy or prolonged rain, melting snow, coastal storm surges, blocked storm drainage systems, or levee dam failure… Oh my! All of these scenarios can cause flooding in your commercial property.

(And secret’s out… Water damage isn’t as cheap to repair as you think it is! Water damage can cost a business owner anywhere from $5,000 to $50,000…)

The solution? Flood insurance is a type of property insurance “that covers a dwelling for losses sustained by water damage specifically due to flooding,” according to Investopedia.

Premises Liability Insurance

Premises liability coverage pays claims for accidents that involve guests that take place on a business property. Regardless, a property owner, by law, is responsible to make appropriate efforts to ensure those visiting their property are entering a safe environment.

Of course, this is not a comprehensive list of all the commercial insurance you might need as a property owner. The coverage necessary will vary depending on your industry, location, etc.

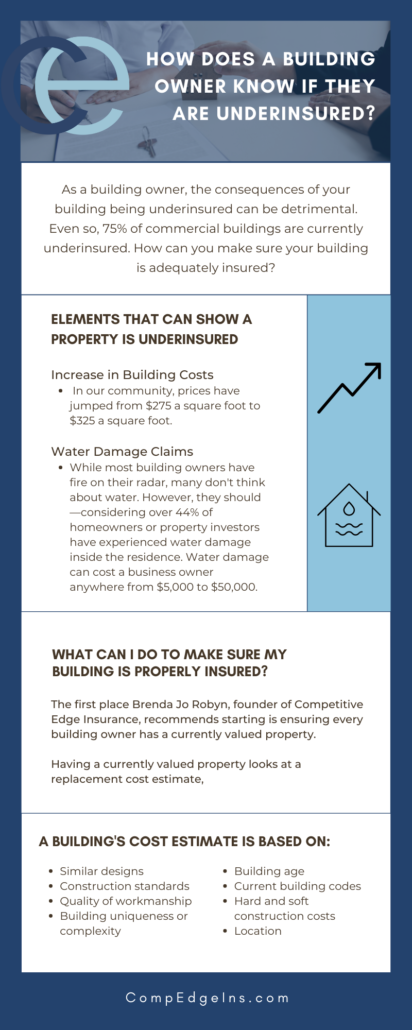

What Happens If You’re Underinsured?

So, what happens if your coverage doesn’t cover what you need? Well, here Brenda Jo Robyn, Founder of Competitive Edge Insurance provides an example.

[Insert Video: https://drive.google.com/file/d/1MV72vxmwmHykFSiALeteiCjp_wjkbqrT/view?usp=sharing]

According to Brenda Jo, some individuals are having difficulty placing property coverage for a building. Why? Because many buildings today now have solar panels.

Interestingly enough in some of these cases, the property inside the building is actually worth more than the building itself.

“So, now you have solar panels, which introduces a possibility of a leak. The panels may be installed perfectly; but in California, you have earth movement and water can intrude over time.

“I see many companies approaching California building owners who have flat roofs, selling them solar panels because then they can self-generate electricity for the building and gather back income.

If you have a manufacturing unit inside a building that has property that’s worth more than the building itself, that’s now an issue in California because of the potential for earth movement and therefore, weather intrusion.”

This weather intrusion poses an issue for a building owner looking to get insured. It’s important to consult your broker prior to investing in commercial property, or commercial property enhancements, as it could lead to greater issues down the line.

Want to find out if you need to up your coverage? Read on in “How Does a Business Owner Know If They Are Underinsured?”