Insurance for your business isn’t one size fits all. As we’ve well learned, various industries have different requirements. This rings true, especially for insurance requirements regarding construction, manufacturing, and even tech start-ups.

Requirements can be regulatory or contractual. Moreover, depending on your industry you might need varying levels and types of insurance. Let’s discuss some aspects that stand across the board.

Workers’ Compensation Insurance

Workers’ compensation insurance, purchased by employers, is insurance that covers the medical costs and lost wages for employees who are injured during the course of work for the insured.

Workers’ compensation benefits and wages are provided in exchange for eliminating the employee’s right to file a lawsuit against their employer’s negligence.

Workers’ compensation insurance is required by law in California, and can help pay for:

- Immediate medical costs (i.e. emergency room expenses)

- Ongoing medical costs (i.e. physical therapy)

- Partial lost wages while the employee is unable to work

Lack of proper coverage can result in fines and even criminal exposure.

Workers’ compensation insurance is extra important in the construction and manufacturing settings, where accidents are more likely to occur. This considered, businesses within the construction and manufacturing industries might opt for higher levels of workers’ compensation to keep their employees and business safe.

General Liability Insurance

General liability insurance (GLI), also known as business liability insurance or commercial general liability insurance, “helps protect your business from claims of bodily injury or property damage that can come up during normal business operations.”

This is important for construction and manufacturing businesses where hands-on work is occurring but also for tech start-ups. According to Insureon, general liability insurance covers “the cost of legal fees and settlements if your company is sued for:

- Client injuries

- Client property damage

- Advertising injuries, like copyright infringement, libel, and slander

General liability insurance is often required as part of a property lease, mortgage, or client contract.” Moreover, the cost of your GLI will depend on the level of risk your company faces.

If you don’t have GLI, medical expenses and property damages will need to be paid for out of pocket. Depending on the injury or event, not investing in general liability insurance could cost you your business.

Employment Practices Liability Insurance

Employment Practices Liability Insurance (EPLI) is insurance that “provides coverage to employers against claims made by employees.”

Claims can be made for an assortment of reasons, including:

- Wrongful Termination

- Sexual Harassment

- Wage-Related Claims

- Claims of Unequal or Unfair Pay Discrimination Claims (i.e. age, race, gender, sexual orientation)

- Third-Party Claims

- And more

The primary industries that are susceptible to EPLI claims include healthcare, professional services, restaurant, food services, retail, and manufacturing and construction.

Read on to find out if your construction business needs EPLI.

Cyber Liability Insurance

In our digital age today, more businesses than ever are falling victim to cyber-attacks. Having a cyber liability policy in place, for any business, is crucial to keeping your business and your clients safe. This stands even more true for tech start-ups that manage sensitive information and high volumes of data.

There is both first and third-party coverage available. Implementing a quality cyber liability policy can help pay for regulatory fines and penalties, credit and fraud monitoring services, crisis management and public relations, finding and addressing the security defect, and more.

Complying with Insurance Requirements: Things to Note

The insurance policies listed above are not, of course, an exhaustive list of insurance requirements all construction, manufacturing, and tech start-ups need to meet; but rather, a list to get you thinking about insuring your business.

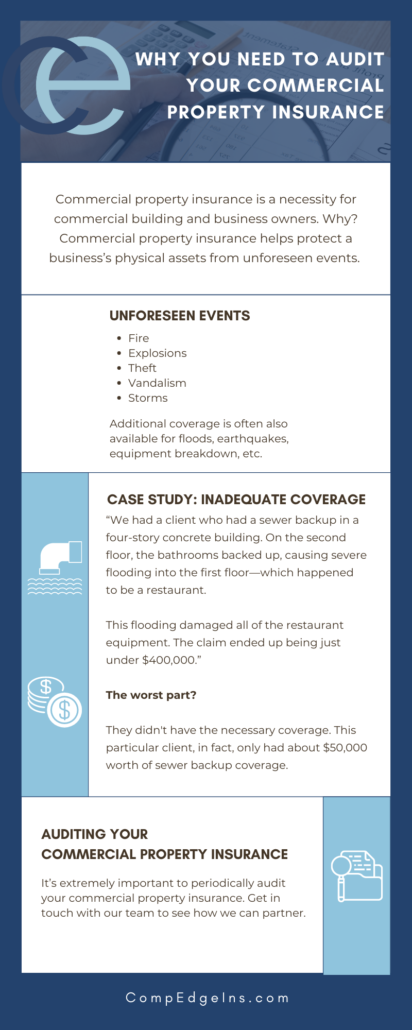

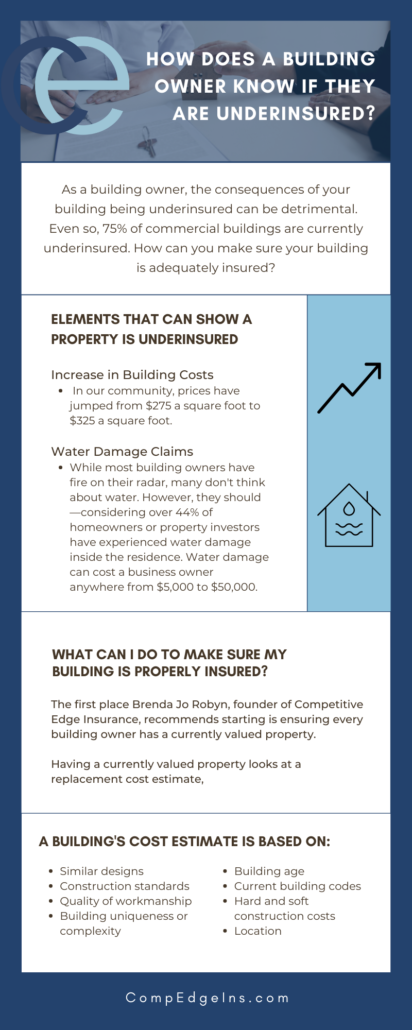

You might also need automobile liability and property damage Insurance, commercial property insurance, errors and omissions insurance (E&O), the list goes on.

Regardless, there are additional elements to consider regarding insuring any one of these three businesses. Let’s discuss some final things to note.

Occupational Safety and Health Administration

The Occupational Safety and Health Administration, also known as OSHA, has particular requirements regarding insurance as well as health and safety practices for a variety of industries.

Visit the OSHA website for additional information.

Certificates of Insurance

In any project, it’s important to make sure you have the proper insurance to protect yourself and all parties involved.

Every contract with a vendor or a customer will have an indemnity or insurance section of what they want to see from you as far as insurance is concerned. This includes documents that extend your policy to cover them. Those requirements are contractually driven, which means a certificate is necessary.

A Certificate of Insurance (COI) gives a summary of what coverages someone has, whether it be general liability, workers’ compensation, or property. A COI can also include a description of coverages that might be there or attached; such as additional insured status or waivers of subrogation.

Read on for more on what you need to know about certificates of insurance.

Contract Wording

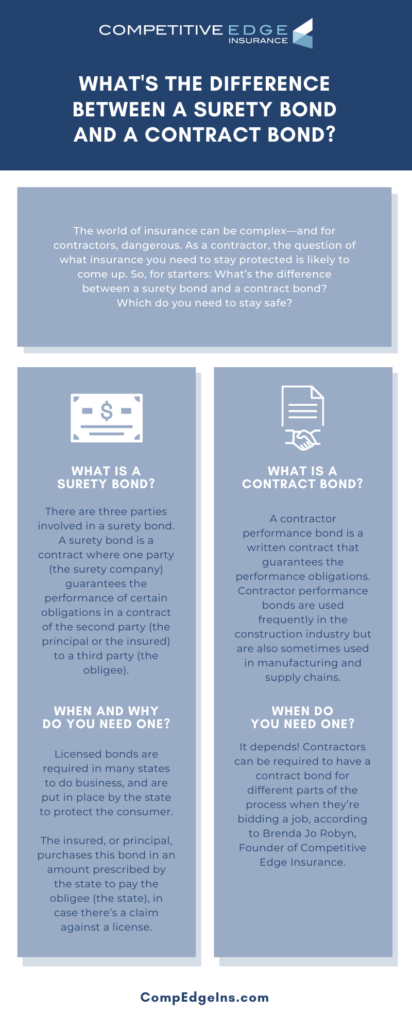

A written contract is a printed document that is legally binding and details what parties can or cannot do. For this reason, the contractual language is extremely important. Contracts for construction, manufacturing, and tech start-ups might include hold harmless clauses and/or indemnification clauses.

Hold Harmless Clause

What is a hold harmless clause? According to Investopedia, “a hold harmless clause is used to protect a party in a contract from liability for damages or losses. In signing such a clause, the other party accepts responsibility for certain risks involved in contracting for the service. In some states, the use of a hold harmless clause is prohibited in certain construction jobs.”

Indemnification Clause

An indemnification or indemnity clause protects “one party from liability if a third-party or third entity is harmed in any way. It’s a clause that contractually obligates one party to compensate another party for losses or damages that have occurred or could occur in the future.”

For this reason, the wording in such contracts must be crystal clear.

With the influx of remote employees in current and previous years, it’s important to consider how workers’ compensation policies might change. Read on for more information on what workers’ compensation looks like for remote employees.