Competitive Edge Insurance is a commercial insurance brokerage that specializes in hard-to-place risks. This includes businesses that are in chaos or crisis with high-risk exposures such as construction and development, property investors and flippers, and those with excess losses or claims.

In 2022, we’re observing a noticeable change in favor of insurance buyers. In turn, we are optimistic for many segments of the commercial lines market in the coming year. Welcome to “Insurance Trends in 2022: What to Watch For.”

Let’s dive in.

From Pandemic to Endemic

“Adaptation is a profound process. Means you figure out how to thrive in the world.” —John Laroch

As we well know, COVID-19 is an ongoing issue. In fact, variants have led many to expect that COVID-19 is here to stay.

Regardless, the sentiment, at least in the insurance industry, has shifted from uncertainty to adaptation.

For the past 10 quarters, rate increases have averaged 10%. Capital in the reinsurance market has increased by 30% which provides support against a large loss event, catastrophe, economic turmoil, and/or adverse claims.

In 2022, we recommend insurees proceed with caution. Additionally, we anticipate price increases to slow. Please note, however, the word “slow” in this sentence. Increases are expected to slow, not create a downward trend in pricing.

Today’s World of Insurance: An Overview

As we know, the past 18 months have been nothing short of eventful. This considered, what are we observing in the insurance world today? Here are a few elements.

- Catastrophic Losses Continue

- Social Inflation

- Skilled Labor Shortages

- Supply Chain Disruptions

Did you know that according to a study from the Society for Human Resource Management, nearly 90% of businesses are having a hard time filling open positions?

Next, let’s dive into each insurance sector a bit deeper: cyber, commercial property, auto, and workers’ compensation.

Cyber Insurance

When it comes to cyber insurance, premiums are rising but covering less.

What’s Causing Insurance to Increase?

- Cyber extortion jumped by 150% in a year

- Companies are more likely to rely on outside attorneys to handle cyber response (in order to contain potential lawsuits)

- Every claims category has increased in the past year; cases of malicious breaches and unintentional disclosure increased by 18%

- Cyber coverages are expected to rise sharply, 40% to 50% for optimal risks and 50% to 100% or more for less optimal risks, seeing as ransomware attacks continue to crowd the cyber insurance market

Additionally, executives do not have the knowledge to properly insure their companies from cyber risk. Here are some statistics from Munich RE to paint a picture for you:

- “81% of C-level respondents think their company is not adequately protected against cyberthreats

- 35% are considering taking out an insurance policy and will very likely do so

- Only 34% of C-level respondents have been in contact with their insurers

- One out of four C-level respondents was totally unaware of the opportunities that cyber solutions offer

- 17% of C-level respondents still do not have an overview of the cyber insurance products on the market”

The bottom line? C-level executives, while they may be concerned about cyber threats, do not have an understanding of what insurance products and services are available to them.

Commercial Property

What Elements Are Driving Rates?

- Increasing frequency of natural catastrophes, as well as the severity of those events

- Higher rebuilding costs due to price inflation of materials and labor shortages

Today, however, commercial property markets are stabilizing. Additionally, increased rates are slowing while capacity is increasing.

We can also anticipate more favorable terms for clients who mitigate risk. Property owners who have been working hard to mitigate risk and decrease claims can see more favorable terms and conditions, and possibly lower rates.

This benefits commercial insurance buyers that maintain quality risks with strong data to back them up. However, rates will continue to be impacted by the location of the risk.

Companies in areas at high risk of natural catastrophes, such as tornadoes, hurricanes, hailstorms, and wildfires, are seeing the highest rate increases, as well as non-renewals and even difficulty in securing coverage. For example, in wildfire areas of California and wind zones of Florida, rates have increased by over 20%.

Auto Insurance

Rates have gone up and up. But what’s driving the increase?

What’s Causing Auto Insurance Rates to Increase?

- An increasing amount of accidents and deaths caused by distracted driving

- Higher medical costs for accident victims

- Rapidly climbing repair costs for vehicles exacerbated by the disrupted supply chain for parts and paucity of skilled and trained labor

As a result, we expect to see averages of 5-15% increases in both commercial and personal auto insurance in 2022.

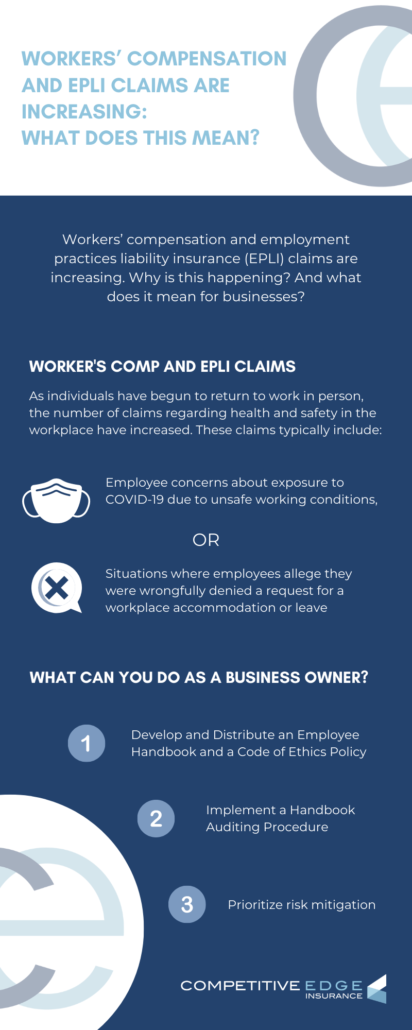

Workers’ Compensation Insurance

Workers’ compensation is a mixed bag.

There’s a base that’s put into play by The Workers’ Compensation Insurance Rating Bureau of California (WCIRB), which is our rating and statistical bureau for data. The WCIRB gives us the trends and where to go.

The state fund has announced rate increases, the 2022 WCIRB new policy assessment increase sits at 5.9318%.

Beginning January 1, 2022, new assessment levels took effect for the six workers’ compensation surcharges administered by the California Department of Industrial Relations (DIR). The six will total 5.9318% in 2022, compared to 3.9590% in 2021.

For more information on rate increases between 2021 and 2022, visit the graph below.

How Can You Prepare?

Let’s talk about risk management.

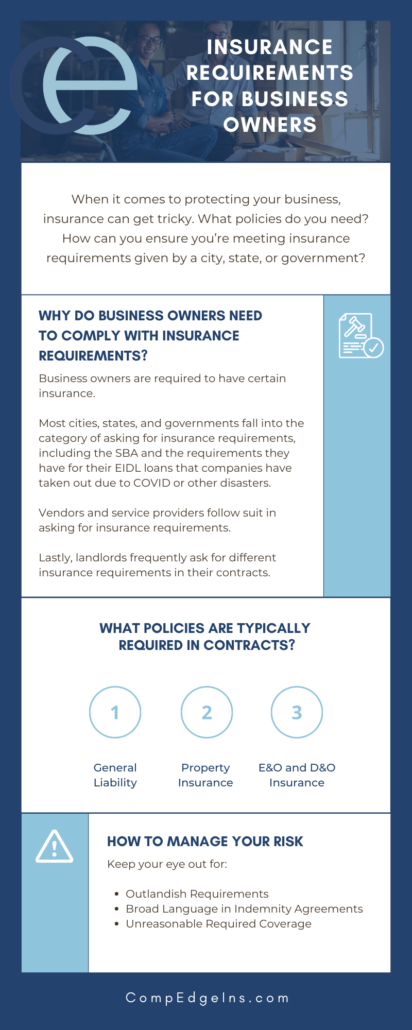

First things first, review your policies before they expire!

It is estimated that commercial properties were undervalued for underwriting purposes by more than 30% in November 2021 policies annually.

To rectify undervaluation, more frequent, in-depth property risk appraisals—that take into account more extreme weather events, potential supply chain hurdles, and inflation trends—are recommended.

Second, write your own story. Don’t let the underwriters do it for you! Work with your insurance broker and risk representative to take appropriate steps to reduce your risks whenever possible. This will make you more attractive to underwriters.

Below is simply an outline of factors that owners can address to influence the most favorable underwriting profile, which leads to the most favorable terms, conditions, and pricing:

- Take inventory of assets

- Pinpoint current exposures and cost drivers

- Update contracts to the current environment

- Review existing risk management techniques

- Highlight business continuity plans and loss control measures in place

- Build a company culture focused on safety

- Manage claims efficiently

- Be weather-ready

Additionally, to reduce negative consequences from supply chain crunches and labor shortages in the aftermath of a catastrophe, “risk managers and property owners should consider entering agreements with builders before an event occurs to ensure the availability of materials and manpower for the restoration job.”

Underwriters are more critical now than ever on property, asking in-depth questions on what you’re doing to control your risks; not only to employees but to tenants and visitors.

Read on for more on how to prepare as well as what to expect from workers’ compensation policy renewals this year.